By AP Economics Writer Christopher Al Gerber

WASHINGTON (AP) — Federal Reserve Chairman Jerome Powell on Tuesday stuck with his position that the central bank will hold key rates while waiting to see how it will affect President Donald Trump’s tariffs.

Speaking at a European Central Bank meeting in Sintra, Portugal, Powell said that US inflation is likely to recover later this summer, but acknowledged that the timing and magnitude of the price rise from duties is uncertain. However, he said the Fed will put interest rates on hold while assessing the impact of tariffs on the US economy.

“As long as the economy is in a solid form, I think the wise thing we should do is wait and see what those effects are,” Powell said of the drastic obligations Trump has imposed this year.

Powell’s comments highlighted the gap between US Central Bank leaders and the Trump administration. Trump has repeatedly urged the Fed to cut its key rates. He says U.S. taxpayers will save billions of dollars in interest costs on large federal debts and boost the economy. The fight threatens traditional independence from federal government politics, but financial markets have not responded to Trump’s criticism since the Supreme Court showed that the president could not fire the chairman.

The Fed’s chairman also said that without tariffs, the Fed would probably cut its important fees now. After seeing how big the tariffs Trump proposed were, the central bank went “pending” and economists began predicting higher inflation, according to Powell.

At the same time, Powell did not rule out fee cuts at the Fed’s next policy meeting on July 29-30.

“I don’t meet from the table or in person on top of the table,” Powell said. However, most economists hope that the Fed will not lower interest rates until early September.

On Monday, the president again attacked Powell, extending criticism across the Fed Management Committee, which will take part in the interest rate decision.

“The board just sits there and watches, so they’re going to be responsible as well,” Trump said. The attack on the board will put pressure on individual Fed officials, including Gov. Chris Waller, who is mentioned as a potential successor to Powell, which will end in May 2026.

During a panel discussion with other central bankers, when asked if he would continue to wake up at night, Powell mentioned the fact that he only had ten months left in his term.

“What I want is for everyone at the Fed to provide an economy with price stability, maximum employment and financial stability,” he said.

Powell also asked if Trump’s attack would make his job difficult, and he replied, “I’m very focused on doing my job.”

European Central Bank President Christine Lagarde, Governor of the Bank of Japan, Kawada Sano, and Bank of England Governor Andrew Bailey joined the audience and praised Powell’s comments.

“We’re going to do exactly the same thing Jay Powell did,” Lagarde said. “The same thing.”

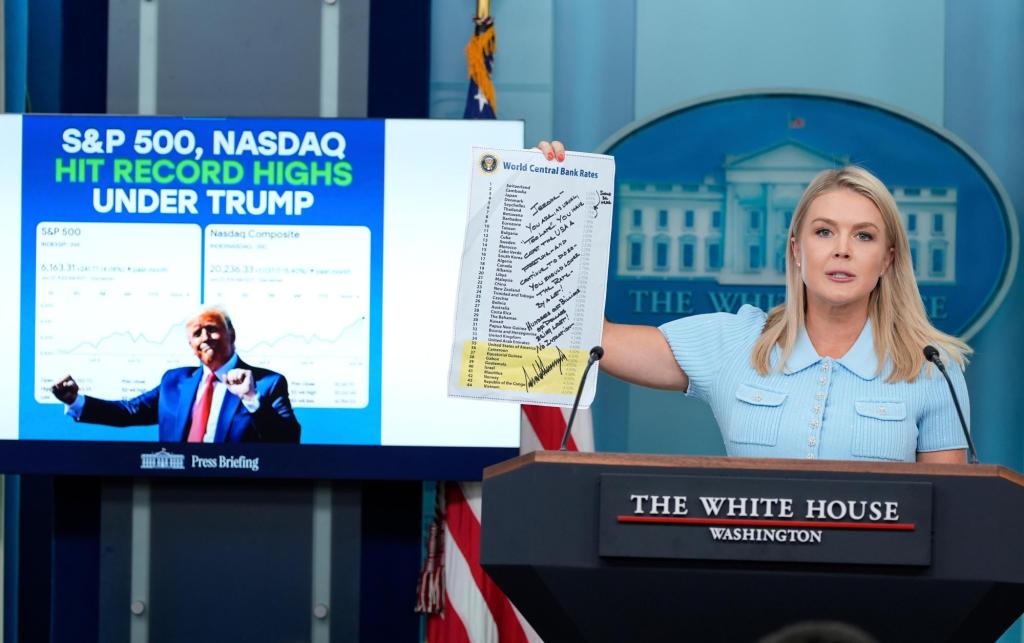

On Monday, Trump posted to social media on social media, listing 44 countries in order of interest rates set by central banks. The list showed that the short-term rates in Switzerland, Cambodia and Japan ranged between 0.25% and 0.5%. “You should be here,” Trump wrote on the list, referring to the Fed.

However, central banks usually lower rates when the economy is weak, boost borrowing, and support spending and growth. The Fed has cut short-term rates to near zero during the pandemic for that reason. To combat the worst inflationary spike in 40 years, we rapidly raised borrowing costs in 2022 and 2023.

Trump has focused specifically on the idea that cutting the Fed rate would significantly reduce government borrowing costs.

However, this is not necessarily the case that cuts reduce other borrowing costs, such as mortgages, car loans, and business loans. The Fed’s short-term rates control over other interest rates, but the market also plays a key role.

As a result, interest rate reductions by the Fed do not automatically reduce interest rates paid by Treasury securities, particularly long-term interest rates such as 10-year Treasury yields.

In fact, when Powell Fed first cut its short-term rate last September, the 10-year yield actually increased, lifting mortgage rates and other borrowing costs.

The Fed has kept its major short-term interest rates at around 4.3% this year, after cutting three times in 2024.

At a press conference in June, Powell proposed that the central bank would “learn more over the summer” about whether President Donald Trump’s drastic tariffs would boost inflation. Comments suggested that the Fed would not consider the reduction rate until the September meeting.

But a few days later, Fed governors Waller and Michelle Bowman, both appointed by Trump, said it is unlikely that tariffs will lead to sustained inflation. Both showed that they are likely to support reducing the Fed’s rate in July.

So far, inflation has remained largely cooled despite mandatory obligations on almost all US imports. Consumer prices rose just 2.4% in May compared to the previous year, not far from the Federal Reserve’s 2% target, much lower than a year ago.

Original issue: July 1st, 2025, 10:55am EDT