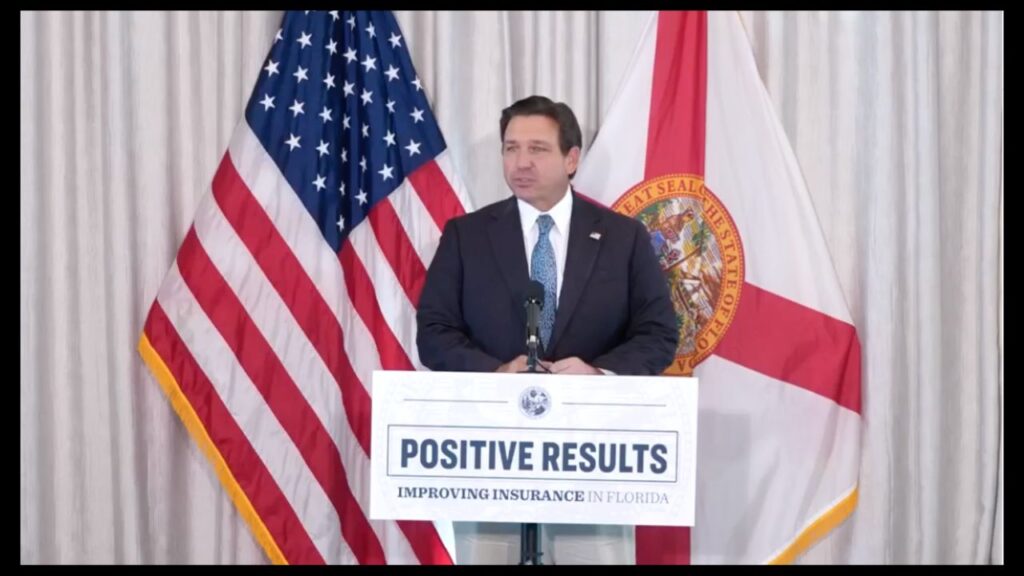

Governor Ron DeSantis announced that Florida drivers will soon receive nearly $1 billion in auto insurance reimbursements as the state’s insurance market continues to show signs of stabilization and improvement with reform. Reimbursements will be made by Progressive Insurance, which cites Florida’s 2023 tort and insurance reform as the driving force behind reducing loss costs and increasing profitability.

DeSantis was joined by Insurance Commissioner Michael Jaworski to highlight how the state’s sweeping insurance reforms have reduced litigation, attracted new insurance companies and lowered auto and homeowners insurance premiums. “Florida’s insurance market has stabilized with lower auto and home insurance premiums and fewer frivolous lawsuits,” DeSantis said. “Florida’s top five auto insurance companies are cutting interest rates by more than 6% on average this year, and Progressive’s $1 billion loan is just the beginning.”

Auto insurance refunds and market profits

Progressive recorded $950 million in policyholder credit costs in September, the equivalent of profits earned over the three years ending in December 2025, according to state regulators. Approximately 2.7 million Florida policyholders are expected to receive the credit, and other large insurance companies are likely to follow suit.

Secretary Jaworski praised this progress, noting that Florida’s top five auto insurers, which account for 78% of the state’s market, expect premiums to decline by an average of 6.5% in 2025. “OIR is working closely with companies to ensure these credits are properly issued to policyholders,” Jaworski said. “We are watching closely, and businesses must act in the best economic interest of Florida consumers.”

Chief Financial Officer Blaise Ingoglia added that the reforms are paying off for drivers. “It’s a good day when insurance companies write checks to policyholders rather than the other way around,” Ingoglia said. “Thanks to the governor and the Legislature, the Florida market is becoming fairer and stronger.”

Homeowners are also seeking relief.

Homeowners are also benefiting from this reform. Since the beginning of 2024, the Office of Insurance Regulation (OIR) has received more than 150 requests for rate reductions or zero percent increases, with 33 companies requesting reductions and 46 companies maintaining stable rates. Florida Peninsula Insurance Company recently applied for the largest interest rate reduction in the company’s history, averaging 8.4% statewide and 12% for condo owners.

Florida had the nation’s lowest average homeownership rate increase in 2024 (just 1%), while 33 other states had double-digit increases, according to data from S&P Global and the Insurance Information Institute. Reinsurance costs also continue to decline, reflecting improved confidence in the state’s insurance environment.

Dropped lawsuits and growth of private market

State officials credit the reforms with reducing insurance-related litigation by 23% from 2023 to 2024, and by an additional 25% in property claims litigation in the first half of 2025. The state’s last insurer, Citizens Property Insurance Corporation, has cut more than 690,000 policies starting in 2024 as private companies re-enter the market. 17 new insurance companies started operations in Florida, generating more than $574 million in surplus for new policyholders.

The domestic property and casualty insurance company reported net profit of $954 million at the end of 2024, up from $292 million in 2023 and a sharp reversal from the $741 million loss in 2022. “These numbers show that the reforms are working,” DeSantis said. “The Florida market is more stable, competitive and consumer-focused than it has been in recent years.”

My Safe Florida Home Extension

DeSantis also announced that funding for the My Safe Florida Home program will continue through 2026. The program provides grants and free wind abatement inspections to help homeowners strengthen their properties and lower their insurance premiums. Since its relaunch in 2022, the program has provided $383 million in subsidies, resulting in average premium savings of $900 per homeowner.

Florida officials say the state’s insurance overhaul has turned a corner, with fewer lawsuits, more competition and the introduction of refund checks. “We are proving that smart reforms can produce real results,” DeSantis said. “This is what accountability and consumer-first policies look like in action.”