Millions of Americans are now at risk of losing healthcare coverage or food aid under the recently passed mega budget by the GOP.

GOP’s $3.3 trillion budget is called “Big, Beautiful Invoices,” and includes $4.5 trillion tax cuts and about $300 billion due to President Donald Trump’s defense and immigration enforcement priorities. To partially offset the sudden costs, the bill aims to cut across the board, but it will attack health and food aid programs the most violently.

Medicaid and Supplementary Nutrition Assistance Program (SNAP) grants face deep reductions and work requirements. Affordable Care Act (ACA) subsidies will also be reduced. These reduction burdens are expected to fall most heavily in existing eligible recipients and rural hospitals that rely on federal assistance to serve state health programs, food banks, and vulnerable populations.

The timing of certain changes to the Social Safety Net program is not entirely clear. For example, the bill does not attach a specific implementation date for SNAP work requirements, but it could be that way as early as this year. Regarding Medicaid requirements, states must begin implementing the Medicaid until the end of 2026. And the biggest cuts in Medicaid and SNAP will not begin until 2028.

During the July 9 report, Larry Levitt, executive vice president of healthcare policy at KFF, a healthcare policy and research organization, said:

With program restrictions and reductions looming, here are the people and programs that are most painful.

People who rely on Medicaid to request health care compensation

According to Medicaid.gov, more than 78 million people were registered with Medicaid in 2025, according to around 23% of the US population. They include eligible low-income adults, pregnant women, children, elderly people, and people with disabilities.

The bill changes to Medicaid will unfold in two stages.

First, states must enact work requirements by the end of 2026, according to the bill. To be enrolled in Medicaid, recipients must demonstrate that they are working, take care of small children, attend school, and receive at least 80 hours of workplace training per 80 hours.

Still, KFF discovered that most people under the age of 65 who received Medicaid are already working full-time or part-time, or attending school. Therefore, it is not a lack of work or schooling that drives Medicaid enrollees out of healthcare coverage. This is the complex deficit that new requirements introduce.

That’s at least how Arkansas worked when they tried to do it.

Arkansas has temporarily implemented a Medicaid work requirement of 80 hours per month for enrollees aged 30-49. From June 2018 to March 2019, restrictions were in place when federal courts defeated it. Meanwhile, a September 2020 survey by Harvard Chan School of Public Health found that 18,000 people (approximately 25% of the target population) lost their healthcare coverage. The losses were primarily due to failure to report or document and were not ineligible.

Furthermore, the policy did not affect employment 18 months after the end of the program. However, compared to those who remained in Medicaid, those who lost their compensation had significant health and financial implications. Almost 50% reported serious medical debt issues, while 56% delayed medical care and 64% were taking medication.

People with chronic illness or disabilities who do not get exemptions are at the highest risk of losing coverage. People with mental health conditions. And people who work hours vary from one month to the next, such as seasonal workers and gig workers. The Congressional Budget Office (CBO) estimates that 5.2 million adults will lose Medicaid due to restrictions on labor requirements.

The second deployment of Medicaid changes will not begin until 2028, but these are the deepest cuts. The provisions include new cost sharing fees between the state and low-income labor registrants for specific healthcare services. The change requires the state to close non-medical health insurance for immigrants.

A June 24 assessment by the Congressional Budget Office predicts that roughly 12 million people will lose their healthcare coverage as a result of all changes to Medicaid and the ACA (details below).

People who receive health insurance through the ACA Marketplace

CBO estimates that changes to ACA requirements and subsidies could result in 8.2 million healthcare coverage losses through the ACA market.

The first change set is a more stringent requirement. Those who access healthcare through the ACA Marketplace face new annual renewal conditions for income and immigration situations. You will also face a short window to register every year.

The most important impact is what the bill lacks. An enhanced premium tax credit extension for ACA Marketplace Coverage is set up during the pandemic, which expires at the end of the year. Premium Tax Credit is a federal grant that helps to cover monthly premium costs for people who purchase health insurance through the ACA Marketplace.

If the tax credit enhancements expire, according to KFF CEO Drew Altman in reports, out-of-pocket prices in the market could increase by more than 75%, and up to 90% in rural areas. He also said enrollment could drop by 50% in rural areas.

Levitt added that the measures in the bill would be in the amount of money “what was effectively partially abolished the ACA,” passed 15 years ago. According to federal data, an estimated 45 million people are registered with health insurance through the ACA. This is about 13% of the US population.

State Health Programs and Rural Hospitals

The federal government could cut Medicaid and ACA, shift financial responsibility to states, and add financial tensions to state health programs and hospitals, particularly community health centers and rural hospitals.

For decades, states have used provider taxes to fund Medicaid and state payments. The bill limits how states can do it.

Robin Rudwitz, KFF’s vice president and director of Medicaid and uninsured programs, said at a press conference that if the state is restricted in how provider taxes are used, the money should be devised other ways, such as reducing other taxes, spending on other programs, or further changes to the Medicaid program.

Also, reductions mean hospitals receive lower payments. This means that hospitals may need to scale back certain services or close them completely. Hospitals with low margins, such as rural hospitals, can face the biggest obstacles.

KFF estimates that 12 states with a large rural population and Medicaid expansion could reduce federal spending on programs by more than $5 billion over a decade. Kentucky is expected to lose $12 billion. This is the best of all states.

Kentucky, for example, relies heavily on provider tax. The Kentucky Hospital Association, which represents more than 100 hospitals in the state, says the bill cuts put 20,000 people in danger of losing their jobs. A University of North Carolina survey found that 35 rural hospitals in Kentucky could be at risk of closures due to the provisions of the bill.

The bill has one source of hope for rural hospitals. The state may apply to access a $50 billion fund for five years from 2027. “Even if we delay the rescue, we will not arrive quickly enough to prevent the closure,” Levitt said.

People who need food assistance

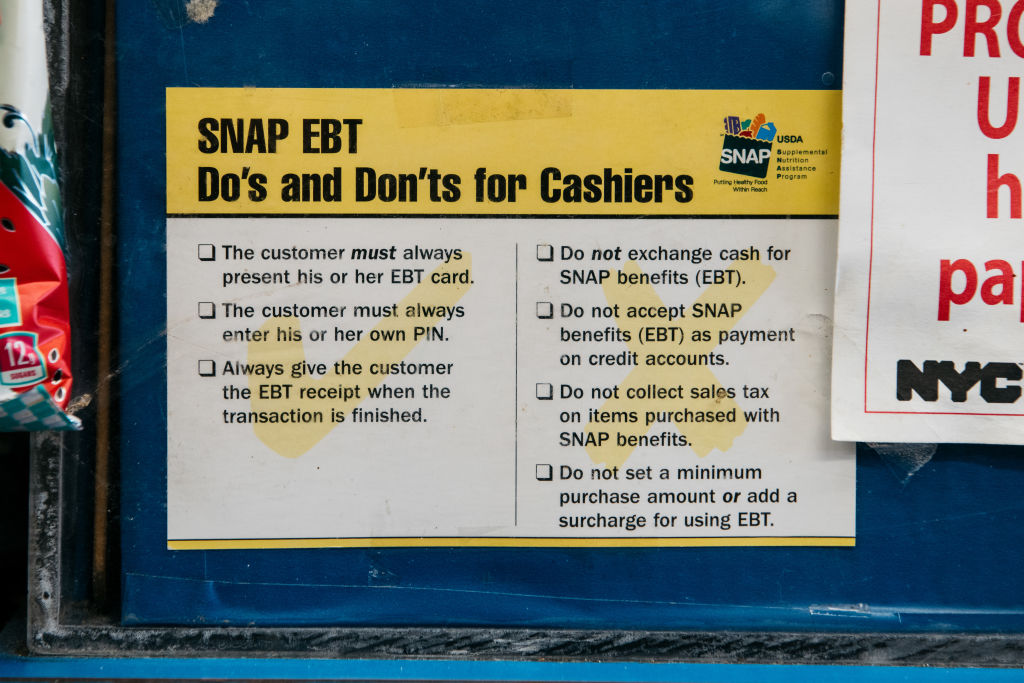

Like Medicaid, low-income Americans with SNAP eligible face new work requirements soon this year and will be affected by funding cuts in the second half of 2028. Total reductions in bill’s SNAP spending: $295 billion over the next decade.

According to the USDA, more than 42 million people receive SNAP benefits, according to about 12% of the US population.

It is worth noting that the SNAP program already incorporates work requirements. Those without dependents, ages 18-49, must work at least 20 hours or 80 hours a month. However, the bill will raise the age limit to 55. This means millions of people will be affected. It also eliminates or strengthens state exemption standards to waive work requirements for certain individuals.

According to the Centre for Budget and Policy Priorities (CBPP), the issues remain with the existing snap work requirements. Increased management burden, more people lose support, and there is no improvement in long-term employment outcomes.

Although the food bank does not rely directly on SNAP to provide services, the losses in SNAP funds could put additional pressure on already trained programs. Feeding America, a national network of food banks, estimates that the bill’s provisions could reduce between 600 billion to 9 billion meals a year.

More about Nerdwallet

Anna Helhoski writes for Nald Wallet. Email: anna@nerdwallet.com. Twitter: @annahelhoski.

Articles that are not online: Who is feeling the pain of budget cuts? It originally appeared in Nerdwallet.