Associated Press Economics Writer Paul Wiseman

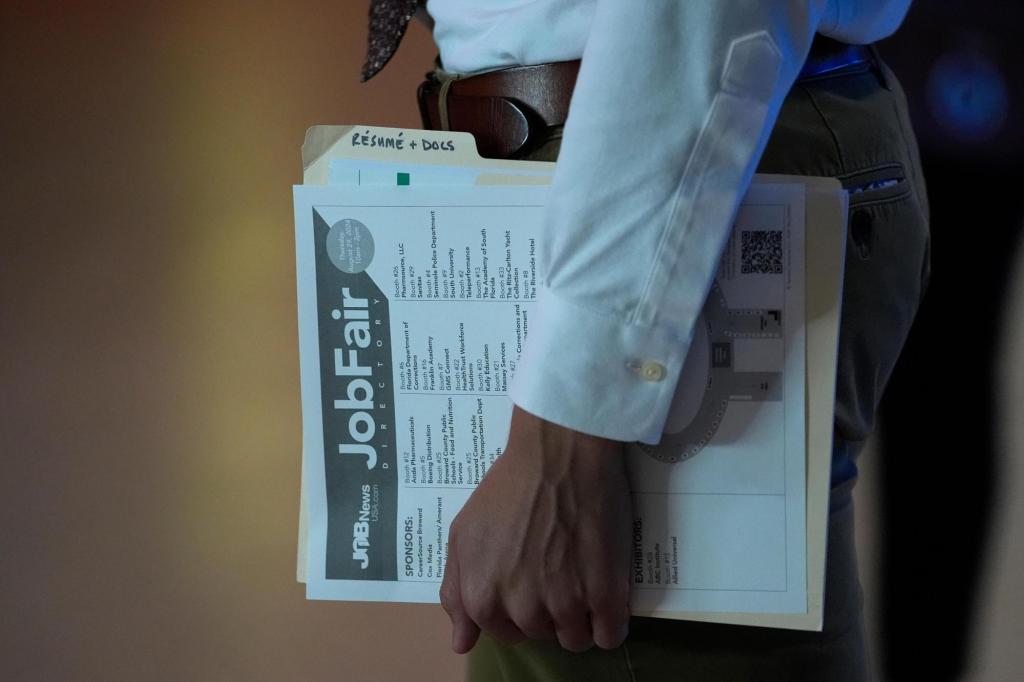

WASHINGTON (AP) — U.S. employers added 151,000 solid jobs last month, but the outlook is cloudy as President Donald promises to threaten a trade war, remove federal labor and deport millions of migrants.

The Labor Bureau reported on Friday that employment has increased since the 125,000 revision in January. The economist was hoping for 160,000 new jobs last month.

The unemployment rate rose slightly to 4.1% as unemployed Americans rose 203,000.

Employment increased in healthcare, finance, transportation and warehouses. The federal government has cut 10,000 jobs, the most since June 2022, but economists don’t expect Trump’s federal layoffs to have many impacts until March’s jobs are reported. The restaurants and bars cut jobs of nearly 28,000 last month, along with nearly 30,000 losses in January.

“The solid February employment report shows that the economy remains healthy, but fear of what could come next is likely to overshadow positive news from today’s release,” said Josh Jamner, investment analyst at Clearbridge Investments.

The job market has been extremely resilient over the past year despite high interest rates.

Employment was continuing and he was defiant of expectations that the US would fall into a recession. The economic unexpected and strong recovery from the 2020 pandemic recession lost a surge in inflation that peaked in June 2022 when prices were 9.1% higher than a year ago.

In response, the Federal Reserve raised benchmark interest rates 11 times in 2022 and 2023, bringing them to the highest level in over 20 years. Despite the high borrowing costs, the economy remained robust despite strong consumer spending, a significant increase in corporate productivity and an influx of immigrants that eased labor shortages.

Inflation has dropped – fell to 2.4% in September – the Fed reversed three courses in 2024, cutting fees. Price cuts were expected this year, but progress inflation has stagnated from the summer and the Fed has been postponed.

Average revenue for January increased by 0.3% last month, down from an increase of 0.4% in January.

Fed officials will see the figures as supporting their current waiting approach to cut current interest rates. With the Fed’s 2% target still modest and inflation rates still remain modest, recent remarks reveal that they want more progress before cutting the benchmark rate further.

Stable employment and economic expansion make it easier for the Fed to stay on the sidelines. If businesses begin laying workers and unemployment rates rise, Fed pressure could rise.

On Thursday, Fed Chris Waller suggested that cuts are unlikely to occur at the central bank march meeting, adding that Fed officials would like to see more data before making further moves.

AP Economics Writer Christopher Al Gerber contributed to this story.

Original release: March 7, 2025 8:52am EST