Kemberley Washington, CPA, Bankrate.com

Since the tax cut extension that he signed into law in 2017, President Donald Trump never kept his goal of significantly changing US tax laws.

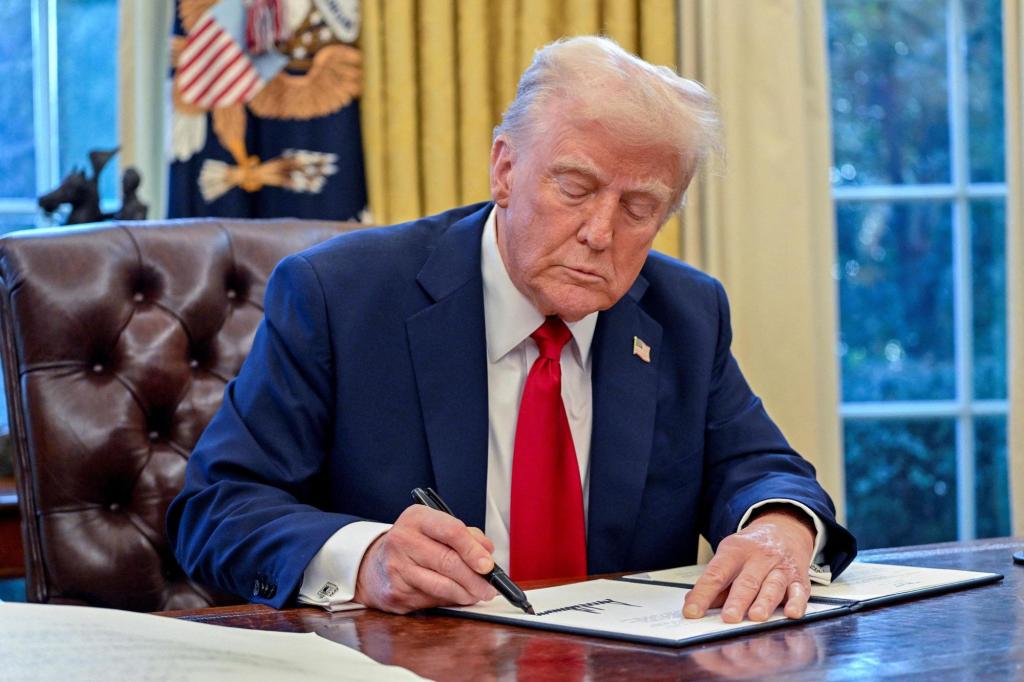

During his first term in office, Trump significantly revised his tax laws by passing the 2017 Tax Cuts and Employment Act (TCJA). Today, many of these tax provisions expire at the end of 2025, leaving the president with the opportunity to extend it and potentially expand its tax policy agenda.

“We are calling for permanent income tax cuts across the board, and we are calling for Americans to be particularly hard hit by inflation with the urgently needed relief,” Trump said in his formal address to Congress in March.

Congressional Republicans are now doing everything they can to turn Trump’s agenda into reality.

Senate Republicans announced a comprehensive tax policy proposal on Wednesday that will permanently extend the tax cuts enacted by the TCJA, adding another new tax cut worth around $1.7 trillion. The cost of extending the TCJA alone will increase government revenues of up to $4 trillion over a decade.

In February, the House of Representatives passed a budget blueprint calling for $4.5 trillion and $2 trillion in tax cuts for healthcare and other programs.

Now, the question is whether Senate and House Republicans can agree on a comprehensive tax cut bill. Republicans have a slim majority in Congress, but there is even debate within the party about how to pay tax cuts amid concerns about rising US deficits and massive potential cuts to key programs such as Medicaid.

How tax laws will be changed

It is unclear what the final law will look like, but it appears that there is a high possibility that some sort of tax law overhaul will occur this year.

Under the TCJA, significant changes have been made to individual tax laws, such as a near-conflict conflict with the standard deduction and an increase in the child tax credit from $1,000 to $2,000. Additionally, the highest tax rate for high-income earners has decreased from 39.6% to 37%, with a new 20% deduction being created for certain types of business income.

While some of the TCJA provisions are permanent and other provisions are set to expire at the end of 2025, U.S. lawmakers can include tax provisions needed for the new comprehensive tax bill.

As a result, lawmakers could change other tax laws, along with the possibility of expanding the TCJA’s expiration provisions that effectively maintain the status quo for US taxpayers.

Trump has pledged various tax credits during his campaign and as current president.

Tax removal for people making less than $150,000 Delete the current $10,000 limit on state and local tax deductions.

Below are additional ways to change taxes from 2025 onwards.

1. Tax benefits for small and medium-sized businesses

The TCJA has reduced corporate tax rates to 21% from a gradual system with a top tax rate of 35%. The changes will be permanent and are not part of the TCJA expired clause (although the tax law may be subject to amendments to lawmakers).

However, the TCJA also provided large tax credits to pass-through companies such as partnerships, S-companies and sole owners. If those companies meet revenue limits and eligibility requirements, they can deduct 20% of their qualifying business income or QBI. The regulations are expected to expire at the end of 2025.

There is bipartisan support to extend the QBI deduction, also known as the Section 199A deduction, but it is unclear what will happen at this point.

Additionally, pass-through companies (where business owners report income on personal tax returns and pay personal income tax rates on their income) also benefit from the TCJA lower marginal tax rate.

Jan Lewis, a BMSS advisor and CPA certified public accountant and partner in Ridgeland, Michigan, says that if Congress extends TCJA clauses such as qualifying business income deductions, small business owners will appreciate it. Lewis says the certainty of implementing the law for several years is welcome news rather than constant change.

Some business owners “may feel better about investing in the business and local economy as an extension of the TCJA,” Lewis says.

2. State and Local Tax (Salt) Cap

To pay the TCJA costs, lawmakers have eliminated personal exemptions. This is a way for taxpayers to reduce taxable income, limiting how much taxpayers can claim state and local tax (salt) deductions for $10,000. Salt deductions allow taxpayers to amortise state and local income or sales taxes in addition to property taxes.

On the campaign trail, Trump suggested he wanted to remove the salt limit. Meanwhile, other ideas currently floating by lawmakers include raising the cap from $10,000 to $20,000 or double the amount of joint submissions for married couples. The current $10,000 cap applies to all filing statuses that jointly file a single filer or married filing (the exception is someone who is married but submits separately for someone with a cap of $5,000).

Of course, removing or increasing the cap raises troublesome questions about how to fund extensions of other elements of the TCJA. “Abolishing the salt limit is taking away some of the revenue to pay for other TCJA reforms,” Lewis says.

3. Other proposed tax reductions

Trump also said in his campaign trajectory he wants to eliminate taxes on certain types of income.

– There are no taxes on social security benefits: “The elderly should not pay taxes on social security,” Trump said on social media truth social in July. Some retirees borrow income tax on Social Security benefits if they receive income from other sources that push the Social Security Agency’s income threshold. People with low incomes generally do not pay taxes on Social Security benefits.

– No tax on overtime expenses: In September, Trump proposed elimination of taxes on both overtime salaries and tip income. Trump has not provided additional details on how the plan works, but the Tax Foundation, a nonprofit tax policy organisation, said it could “skew” the workforce by eliminating taxes on overtime pay. In other words, workers may take on more overtime jobs, as they are more attractive than those with payroll exempt from overtime rules.

– No tax on tip income: Trump provided little details to eliminate tax on tip income. However, reopening lawmakers in the U.S. House and Senate have introduced a companion bill that outlines a $25,000 tax credit on tip income. (Read more: Tax credit: How they work, how to charge them)

– Tax credits on interest paid on car loans: Details were vague, but in a speech to the March 4th Congress joint session, Trump said:

– Tax on US expatriates: In October, Trump said he supports cutting taxes for US citizens living abroad. Currently, expatriates are subject to income taxes despite living outside the US and must follow the same rules as taxpayers living in the US. Foreigners must report all taxable income and pay taxes in accordance with US tax laws. That said, the majority of foreign income in 2025, $130,000 for qualified single filers and $260,000 for qualified filing and joint filers — can be excluded from US taxes. Additionally, there is a tax credit to offset the housing costs of foreigners. However, even expatriates eligible for foreign earning income exemptions and other tax benefits must file US tax returns.

4. Customs and External Revenue Services

Since taking office in January, Trump has accepted tariffs. This introduces a minimum 10% tariff on all goods imported into the US, as well as mutual tariffs in more countries, and adopts a 25% tariff on all automobile and auto parts imports, plus a 25% tariff on all products importing oil in Venezuela, a 25% tariff on certain products.

Relatedly, in January, Trump announced that he would create an external revenue service to collect tariffs, obligations and income from foreign sources, true socially. Generally, US companies that purchase foreign goods pay import duties to the US government. Research shows that consumers often make bills for higher tariffs.

“We are accused of our efforts to ensure that we are accused of our efforts to ensure that we are accused of our efforts to ensure that we are accused of our efforts to ensure that we are accused of our efforts to ensure that we are accused of our efforts to ensure that we are accused of our efforts to ensure that we are accused of our efforts to ensure that we are accused of our efforts to ensure that we are accused of our efforts to ensure that we are accused

“In addition to the impact on small businesses, customers who purchase these products are likely to experience financial burdens even under customs duties,” says Samuel.

©2025 Bankrate.com. Distributed by Tribune Content Agency, LLC.