“Consumers are not feeling uneasy after the tariffs are announced,” says the bank’s chief economist.

Consumer trust has been boosted this month as Americans have become more optimistic following the suspension of US and China tariffs.

This month’s index is better than the economists expected.

Other broader emotional indicators have been improved.

The current status index rose to 4.8 points, up to 135.9, while the forecast index surged to 72.8 at 17.4 points, bringing President Donald Trump closer to level before the global tariff announcement on April 2.

Stephanie Gyad, a senior economist at the conference committee, said that bouncebacks were ubiquitous at the beginning of the month, but after the US-China trade ceasefire on May 12, consumer confidence rose sharply. More than half of the responses appeared after the announcement.

US and Chinese officials have agreed to reduce mutual tariffs between the two economies by 115% for 90 days, as negotiators discuss economic and trade policies.

More than expected increases were observed across all age groups, income categories and political affiliations.

“The monthly improvements were greatly driven by consumer expectations, as all three factors, the forecast index from the April low (business conditions, employment outlook, future income) are outlined from the April low,” Guichard said in the report.

The six-month outlook on consumer business conditions, employment availability and income outlook was a varieties, Guichard said.

The written response showed that tariffs were at the very top of consumer minds. Some respondents highlighted concerns that tariffs would raise prices and harm the wider economy, while others hinted at ease inflation and lower gasoline prices.

The White House was pleased with the numbers.

“Despite the end-of-life prophecy by ‘experts’, President Trump’s US tariffs, tax cuts, rapid deregulation and the first economic agenda of domestic energy production continues to be rewarded,” White House spokesman Kush Desai said in a statement.

“Today’s Consumer Trust Report reflects multiple solid inflation and employment reports that Americans have seen under President Trump, and presented a GDP report showing a 22% surge in gross domestic investment in Q1 2025.”

Progress on the trade front

Jeffrey Roach, chief economist at LPL Financial, said trade policy uncertainty is the main driver of exacerbating consumer sentiment and uneasy business owners and eliminating uncertainty, and thus “may be the most powerful catalyst for improving growth trajectory.”

“Trade uncertainty weighs heavily on consumers and businesses. If the administration removes tariff insecurity, economic growth expectations will likely improve,” Roach said in a memo sent by email to the Epoch Times.

“For now, trade policy is a major contributor to capital market volatility, and these conditions appear to last in the short term.”

Over the long Memorial Day weekend, President Donald Trump announced that he would delay the European Union’s 50% tariff until July 9th.

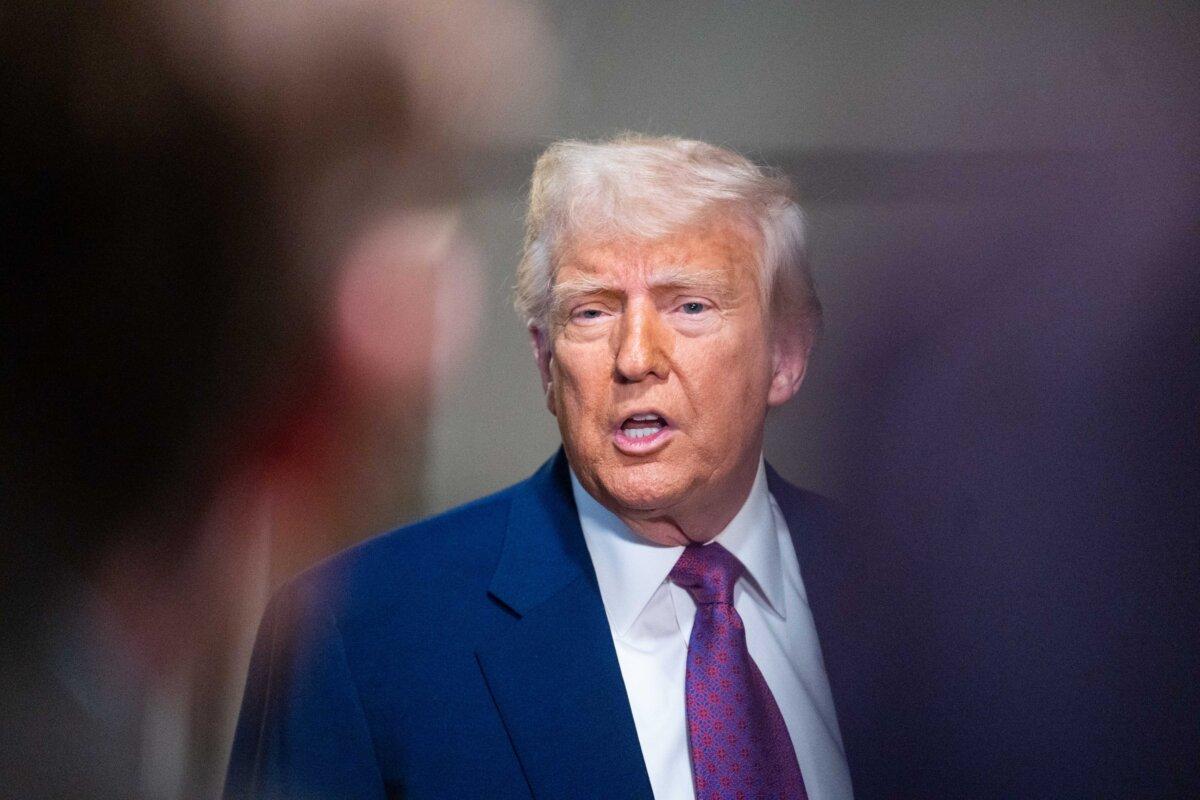

President Donald Trump will arrive at Capitol Hill, Washington on May 20, 2025. Madalina Vasiliu/The Epoch Times

“This is a positive event and I hope to ultimately open up European countries for trade with the United States, like my same demand for China,” Trump said. “They are both very happy and will succeed if they do!”

“I think we’ll probably see a few more deals this week. There’s something very close to the finish. Of course, it depends on the president,” Hassett said.

Deferrals on tariffs, Hassett’s remarks and a surge in consumer confidence have led to stock prices rising to launch a reduced-off trading week.

“It appears that the economic outlook is largely suspended, and mostly suspended,” Comerica Bank Chief Economist Bill Adams said in a memo emailed to the Epoch Times.

“Consumers are not feeling uneasy after tariffs suspend the announcement.”

Efficient data consumption

Over the past few months, economic indicators have been sending mixed signals amidst turbulent tariffs.

Reading in April was slightly better than expected.

Monitoring the underlying health of the economy is important, according to Chris Zaccarelli, CIO at Northlight Asset Management.

“For now, we believe that as long as it takes time to adapt to the ‘new normal’ of rapid changes in trade policy, and as long as there is a recession, there is room for the market to be upside down in the short term,” Zaccarelli said in a memo sent to the Epoch Times by email.

The next major data release is the second estimate of first quarter GDP on May 29th. The initial estimates showed a 0.3% decrease, the first contraction since early 2022.

For now, economic observers are not expecting significant changes.

“A positive revision of GDP advance estimates will benefit recent sentiment and the deeper contraction will likely harm it, but the outcome will not change the economic story,” ITR economics economist Lauren Sarell Baker said in a memo emailed to the Epoch Times.