The market is hoping for great results and guidance from Nvidia after the market closed on Wednesday, and the company has re-delivered, announcing first quarter revenues to $44.1 billion, up 69.6% compared to the first quarter of 2024 at $26 billion. The analyst community had recorded a 1.8% sales surprise and a 3.2% revenue surprise, despite NVIDIA having to write down $8 billion in first quarter revenue due to the export ban on AI chips to China, as the analyst community expected revenue of $43.3 billion and operating profit of 93 cents per share.

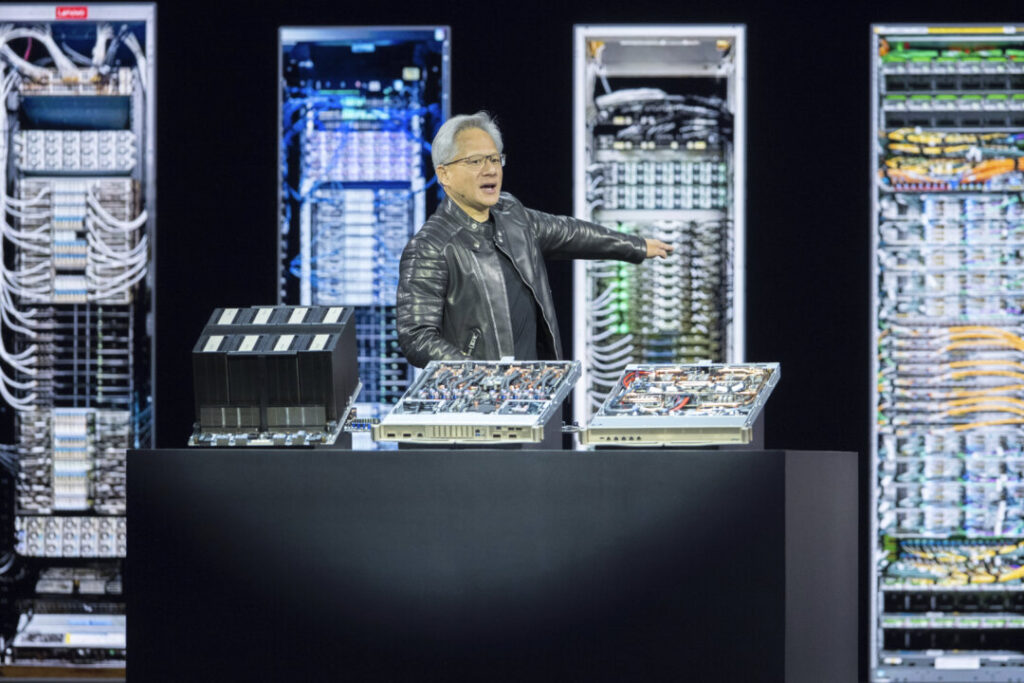

Since Nvidia recently held a quantum computing architecture contest won by D-Wave (QBTS), Nvidia CEO and founder Jensen Huang is now the head cheerleader of AI and quantum computing. Huang continues to draw positive pictures of how AI continues to unfold and expects to literally envelop more aspects of our lives. One observation I made is that young people are clearly obsessed with AI for their excellent internet search and advice. Fortunately, after talking to CNBC’s Jim Cramer and Bloomberg, Huang continued to encourage investors and AI users to cheerfully encourage them to provide cheerful guidance.

This is the most important market news item and what this news means.

– The Bears on Wall Street continue to recycle old ideas to deflect investors, and are pathetic party poop. The main bearish argument is that the “big beautiful” tax bill will cause the federal government’s fiscal deficit to skyrocket and interest rates to rise. Let me explain what happens when there is a tax cut. If the federal government puts more money in your pocket, the consumers usually put that money in the bank and the banks buy more Treasury securities, so tax cuts won’t cause Treasury yields. Furthermore, as money speed increases, prosperity increases and tax revenues often rise. Therefore, the key to economic prosperity is setting tax rates to increase the speed of money.

– I remain optimistic that tariff disruption will be dissipated in the coming months. Furthermore, inflation is expected to decline due to (1) lower oil prices, (2) deflation from China, and (3) excessive stockpiling due to first quarter dumping of goods. Driving consumer trust and personal income increases is a powerful “one-two” punch that maintains strong economic growth. The new “Big Beautiful” tax bill will also encourage consumer confidence and spending, in addition to spending more money on consumer pockets, the Fed’s critical interest rate cuts as well as the imminent Fed’s critical rate cuts.

– A decline in US exports is hampering the ISM manufacturing index. The Institute of Supply Management (ISM) announced that its manufacturing index for May has dropped to 48.5 from 48.7 in April. This represents three consecutive months with an ISM manufacturing index below 50, indicating shrinkage. Production components rose to 45.4 in May, up from 44 in April, while new order components improved to 47.6 in May, up from 47.2 in April. Despite these green shoots, the new export order components plummeted to 40.1 in May, down from 43.1 in April, while the import components plummeted to 39.9 in May, down from 47.1 in April. Manufacturing continues to struggle as only three of the 15 manufacturing industries surveyed reported expansion in May.

– China’s Kaisin Manufacturing Purchase Manager Index fell sharply to 48.3 in May, down from 50.4 in April. This index is called a private factory gauge and is not operated by the Chinese government. Readings below 50 show contraction, so it is clear that higher tariffs on China are at the expense of it. It is also widely reported that tariff negotiations with China are at a dead end, which could lead to an imminent call between President XI and President Trump. The Wall Street Journal reported that China’s leading trade negotiator, Deputy Prime Minister Lifeeng, is playing hardball and has not cooperated with the Trump administration. In the meantime, factory gauges are at their lowest level since 2022 and are expected to remain weak until a trade negotiation breakthrough occurs.

– The European Central Bank (ECB) has provided further evidence for reasons to cut key interest rates for the eighth Thursday. Specifically, eurozone inflation slowed to a 1.9% annual pace in May, down from a 2.2% annual pace. The dramatic decline in service inflation in May helped to reduce eurozone inflation, from its 3.2% annual pace since March 2022 (down from the 4% annual pace in April to the 4% annual pace). The main reason for lower eurozone inflation than in the US is that it is shrinking due to aging of households, based on the PCE (personal consumption expenditure) index, at an annual pace of 2.2%, and because there is no housing inflation in the eurozone, households are shrinking.

– New German Prime Minister Friedrich Merz has hinted that the EU can retaliate against US technology companies if the trade dispute with the Trump administration escalates. Specifically, Meltz said it aims to reduce tariffs and ease tensions with the White House. “At this point, we are strongly protecting US tech companies,” Meltz added, “We can change that, but we don’t want to escalate this conflict. We want to resolve it together.” Obviously, Prime Minister Meltz doesn’t want to fight President Trump. Because there is very little way to retaliate in Germany.

– Interestingly, Germany recently sent its Minister of Economy, Catherina Reich, to Brussels, to appeal to the European Commission to approve a plan to support energy-intensive industries such as cement, glass, iron and chemicals. “Not doing steel production in Germany would mean entering a new dependency,” Reiche said, adding that “no more basic chemical production means entering a new dependency.” Germany is seeking to approve a reduction in electricity rates for energy-intensive industries through EU subsidies. That net zero mandate has caused electricity prices to skyrocket and destroy German industrial bases. Clearly, if Germany receives EU power subsidies, other EU members will also seek similar subsidies. As a result, the final collapse of the EU is approaching as oppressive regulations in Brussels destroy German industry.

– The Ukrainian drone attacks on approximately 40 Russian military aircraft (including the majority of the Russian bomber fleet) deep in Russia are extremely embarrassing for Vladimir Putin. This is a massive escalation and has expanded the battlefield, so the whole world is very nervous about how Putin will react. In the meantime, gold is on track amid all the uncertainty.

Overall, we look forward to seeing why the US is an economic oasis around the world. Not only is US food and energy independent, but there is no oppressive bureaucracy that systematically destroys agriculture and manufacturing with oppressive policies, like the Brussels EU. The Trump administration is essentially a professional business. In fact, the Atlanta Fed’s GDP is currently forecasting an annual GDP growth of 4.6% for the second quarter, which is incredible.

Disclosure: Navellier & Associates owns Nvidia Corp (NVDA) and D-Wave Quantum Inc. (QBTS) in their managed accounts. Louis Navellier and his family’s own Nvidia Corp (NVDA), and D-Wave Quantum Inc. (QBTS) have taken Nvidia Corp (NVDA) through their own accounts via their Navellier managed accounts.

*The views expressed in this article are the views of the author and do not necessarily reflect those of the epoch era.