Erin El Issa, Nerdwallet

It is possible that some Americans are not openly debating finances at home. According to a new Nerdwallet survey conducted online by Harris Poll, 20% of baby boomers (ages 61-79) did not teach their children to save money.

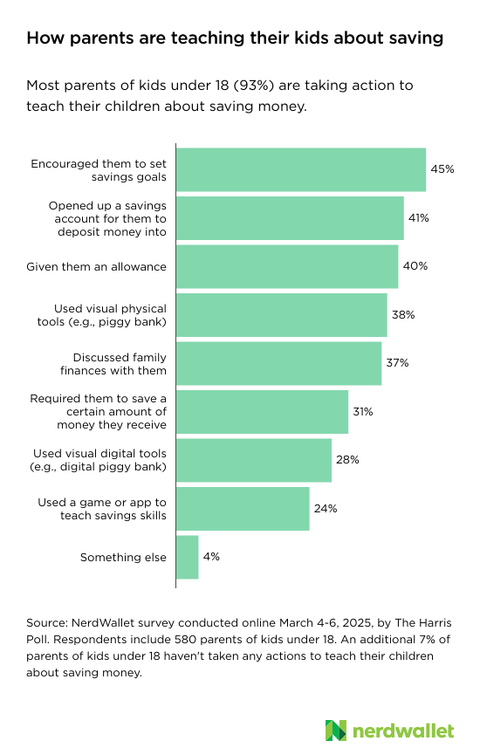

Perhaps because talking about finances is less taboo, parents of young children today prioritize this life lesson. The survey found that 93% of parents of children under the age of 18 take action to teach their children to save money, encouraging them to set savings goals (45%) and encouraging their children to deposit their savings accounts (41%).

If you are a parent who wants to teach your child to save money, here are a few options to consider.

1. Set up your child with age-appropriate savings vehicle

According to the survey, 41% of parents of children under the age of 18 opened savings accounts to help their children deposit their money as a way to teach them about savings. Additionally, some parents of minor children used visual tools, such as physical (38%) or digital (28%), such as piggy banks and savings bottles.

For young children, piggy banks and savings jars are probably a good place to start. Certainly, they have not yet earned interest, but having specific bills and coins will allow them to begin learning how to count sectarian values and cash before moving on to opening a savings account or using a banking app.

You can open a child’s savings account regardless of age that the parent and child own. In addition to your own personal information and photo ID, you will also need to provide your child’s name, date of birth and Social Security number when opening an account. You can choose to use online only banks or local brick-and-mortar stores, but please note that some banks may require an account for minors to open directly. Look for savings account options that don’t charge monthly fees and have the right interest rate.

Recently, there are banking apps for kids as well. These may include educational activities, savings goals functions, allowance tools, and parental controls. The downside is that some apps do not charge monthly fees or pay interest. Therefore, you need to determine whether interactive features are worth the additional cost.

2. Consider giving your child benefits

The survey found that 2 (40%) of five minor children are given allowances to teach them about saving money. For school-age children, this may be a good option. Whether allowances are tied to chores or not, small weekly allowances are a starting point for learning how to manage competing financial priorities, such as savings, spending, and donations.

Research shows that almost a third (31%) of parents of children under the age of 18 require their children to save a certain amount they receive as a way to teach them about savings. You can provide guidelines for children on whether to save themselves, spend, donate, or enable them to decide themselves. This argument can be further discussed by talking to the children about how these decisions are made regarding family finances.

3. Discuss your child about your financial goals and ask about them

Research shows that fewer than two in five minor children (37%) discuss the finances of their children and their families and teach them about money. You obviously don’t want your kids to stress money, but there are age-appropriate ways to use your own finances to teach them about savings.

Consider your own savings goals for the year. Maybe they want to fund an emergency savings account, take time off, or invest 10% of their retirement benefits. Explain what your goal is, why you set it, and how you work to achieve it. Next, ask your child to do the same. Depending on the age of your child, the right goal is to learn the value of various bills and coins, save for special toys and cars, and set aside a certain amount of allowance to give. Once your child has identified their goals, discuss why they want to achieve it and what steps they will take to get there.

Tell your child wants to save money to buy new toys. The cost is $30 and you will receive a $5 per week allowance. The motivation for purchasing is to play together and save seven weeks of allowance to cover the cost of toys and sales tax. (Bonus: Depending on your age, it may be a great opportunity to teach you how to calculate sales tax if your state and/or region charges it.)

The toy may turn out to be a great purchase that has been cherished for years to come. Or maybe your kids will realize they don’t like toys as much as they thought they would. This gives you bonus tips to teach your kids both about salvation and spending.

Bonus: Allow your kids to make bad spending decisions within the scope of the reason

A child’s savings goal may be short-term deferred expenditures rather than long-term savings. And parents have opinions about what their children have decided to buy with limited funds, as they support and save on years of experience. However, it may be wise to allow children to experience the buyer’s regret, unless the item is of age or is appropriate.

Most parents don’t want to see their children disappointed. But allowing children to make mistakes on a small scale is a starting point to discuss how to evaluate them in mind before purchasing, such as buying toys that are not particularly well-made or that are not fun to play with for an hour. Depending on the item, it may be a good opportunity to teach you about your return policy.

Bad shopping now won’t prevent your children from making uninformed purchases in adulthood. However, these early lessons may help you think more critically about how they are spending, and may not spare them out of regrets about a lot of spending in the future.

The complete research method is available in the original article published on Nerdwallet.

Erin El Issa writes for Nald Wallet. Email: erin@nerdwallet.com.

Article research: Most parents originally teach their children to save money on Nerdwallet.

Original issue: May 6, 2025, 3:27pm EDT