There is little thought to be fun for people to file an income tax return, but it’s even worse if you can’t file a return because someone is using your identity.

An increasingly common type of fraud can be prevented by using ID protection pins that are freely available to most US taxpayers through internal revenue services.

IP pins are mandatory for tax submissions by people who are victims of certain types of identity fraud, but they can also provide security as an optional measure.

The IRS online Q&A walks taxpayers through this process. Some of the main elements are:

How do pins work?

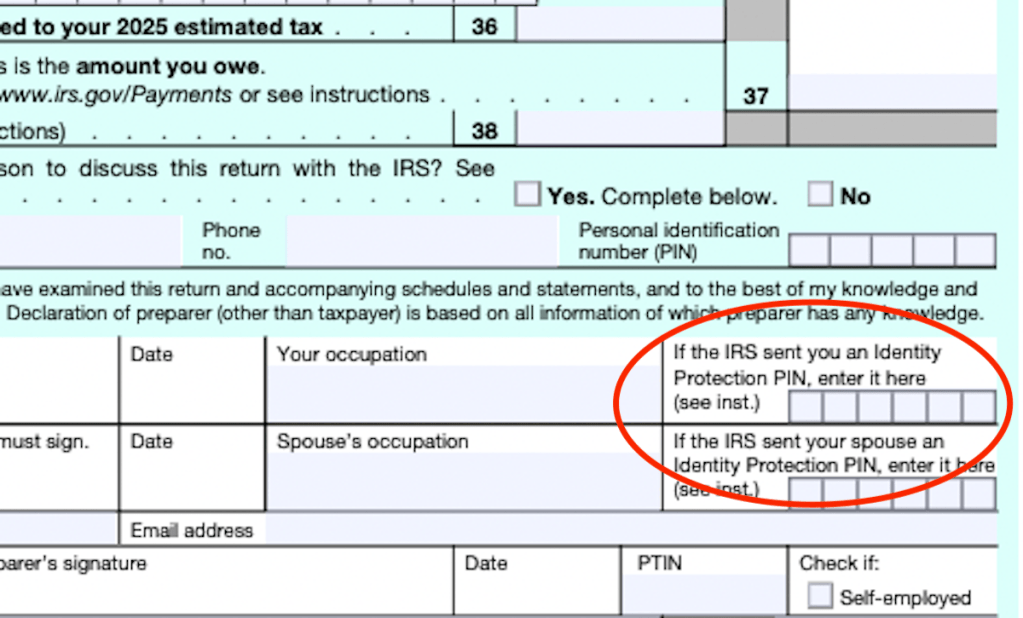

Each year, taxpayers are given a new six-digit code that allows them to file income taxes under their identity. They will be asked to fill out via tax software or electronic forms. For those submitting on paper, the 1040 form has space for pins near the signature line.

How can I request it?

First, you will need an online account using the IRS. If you already have an ID.ME (ID.ME used by many federal and state agencies), you do not need to set up a new agency. You will need a driver’s license or other government ID card. The other information you need to provide is data that the federal government is likely to already have.

Once you have your IRS account, you will have the option to request pins under the (Profile) tab. For the first time each year, new pins are available from your account.

You are already using a signature pin when submitting your taxes. Is it the same?

no. The self-selected 5-digit codes you enter to complete the digital signature of your tax return do not have the same identity security.

What happens if I request a pin and then decide that I don’t want to use it in the future?

If you do not need to use it for theft of past identity information, you can opt out of your IRS account. Taxpayers whose obligations are to be made will receive what is called a CP01A notification from the IRS.

Too late – someone had already requested a tax refund in my name this year. What now?

These instructions from the IRS lay out the steps. You will likely be blocked from electronic filing and will need to submit a paper return on Form 14039, which is identity theft. The agent investigates the issue. The resolution could take several months. Sometimes it takes more than a year.

Original issue: March 24, 2025, 12:56pm EDT