This year, Floridians will enjoy sales tax exemptions on many items.

These items include state park entrances, event tickets and disaster response items.

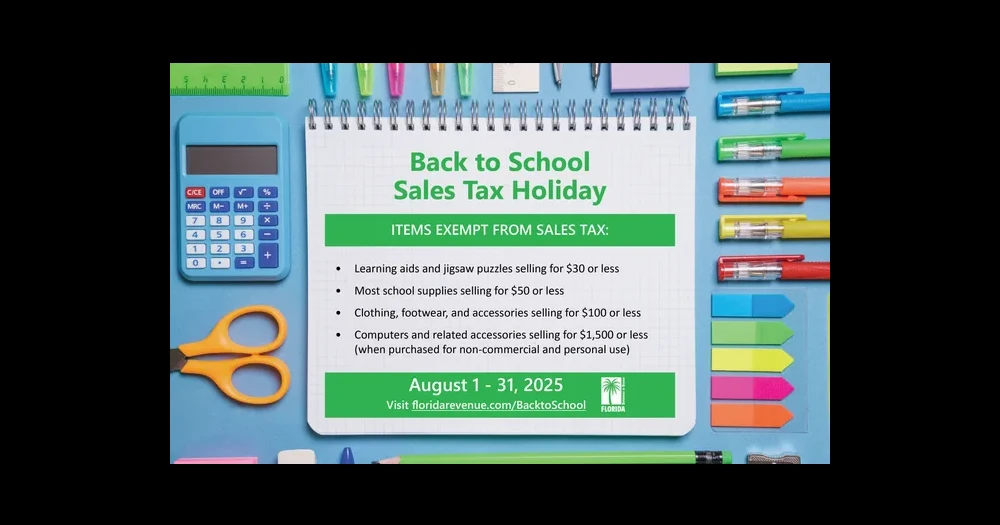

Starting August 1st, sales tax holidays will be effective for return to school. During this period, the following items will be exempt from sales tax:

– Learning AIDS and Jigsaw puzzles up to $30 price – Clothing and accessories up to $100 – Prices up to $50 price – Prices up to $1,500 computers and computer accessories up to $1,500

Also, on August 1st, disaster preparedness items and certain other items will be exempt from sales tax.

Battery (AA cell, AAA cell, C cell, D cell, 6 volts, or 9 volts)

Bicycle helmet

Fire extinguisher

Insect repellent

Ground Anchor System and Tie Down Kit

Life jacket

Portable gas or diesel cans with capacity of less than 5 gallons

Portable Generator

Smoke detection device and carbon monoxide alarm

Sunscreen

Waterproof tarpaulin less than 1,000 square feet.

Outdoor lovers, Floridians, second revised sales tax vacation will be held from September 8, 2025 to December 31, 2025 for the next recreational camping, fishing and hunting supplies.

Hunting supplies

Ammunition and Firearms Accessories

Firearms that use explosives as propellants to contain pistols, rifles, or shotguns

Bows, crossbows and qualified accessories

Camping equipment

The tent was priced under $200

Camping stoves, foldable camping chairs, portable hammocks and sleeping bags cost under $50

Camping Lanterns and Flashlights are priced under $30

Fishing supplies

Rods and reels are priced under $150 (if sold as a set) or under $75 (if sold individually)

Tackle boxes and bags priced under $30

Bait or fishing box prices are less than $10 (if multiple items are sold together) or less than $5 (if sold separately).

Gold, Silver and Platinum Sales Tax Exemptions

Florida excluded sales tax on purchases of gold, silver and platinum bullion on August 1, 2025. Before that day, only units of gold, silver and platinum over $500 were tax-free.