TALHASSEE, Fla. (WFLA) – Florida lawmakers are back in their hometown district once again as they continue to move slowly towards property tax proposals for the next session.

Florida’s tax law, known as the statewide taxpayer’s eyes and ears, has been tracking the property tax debate for quite some time. Dominique Calabro, president and CEO of Florida Tax Law, commented on the topic shortly after the legislative meeting ended.

Florida CFO Blaze Ingoglia says Hillsboro County had nearly $279 million on excess spending

“We’ll not just do something right away, but think about it,” Calabro said. “We won’t amend the Constitution any time soon, so let’s make sure this is something that can last for at least 10 years.”

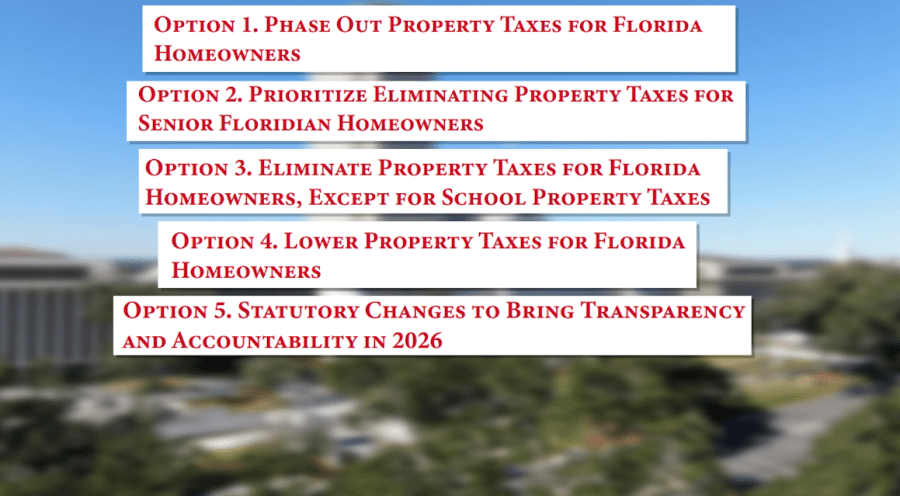

After the 2025 legislative session is wrapped, demand for property tax relief has been strengthened. And while there are no set proposals from Congress yet, Florida Taxwatch has released five options for lawmakers to consider.

Florida Tax Surveillance Reform Options:

Immediate statutory reform: Legislative changes to the 2026 session focused on improving transparency, including defaulting rollback tax rates and strengthening tax notification disclosure requirements. Gradual and multi-year phase-out of property taxes on homestead properties. It provides predictability as local governments adapt to declining revenues. Elderly prioritization: accelerated elimination of property taxes for seniors, providing immediate relief to people with fixed income. Excluding school taxes: Eliminate all non-school property taxes for homeowners, thereby protecting the primary source of public education. Overall reduction: A reduction in percentages based on a simple percentage of the value of a property to achieve immediate and broad tax easing.

However, Florida taxes warn that all options have potential meanings such as loss of local government revenue.

“No matter what you do in all 67 counties, it’s really important to be able to perform core government functions,” said Jeff Notkhamp, Florida Vice President of Tax Enforcement and General Counsel.

This is what David Jolly, the Democratic governor candidate, is most concerned.

“They need to accept a 12% sales tax or have conversations with voters about police refunds, educator refunds, and transportation refunds,” Jolie said. “So I don’t think what feels like a populist is as simple as reflecting the popularity of property tax abolition. Let’s see what the outcome of that property tax abolition will be.”

Despite these fears, Gov. Ron DeSantis continues to commit to providing property tax relief to Floridians.

“Don’t let anyone tell you that property taxes can’t do anything,” DeSantis said. “Trust me, that’s what a entrenched politician will say.”

The House Selection Committee on Property Tax will meet again in October, hoping to prepare the proposal in November.