Elizabeth Renter, Nerdwallet

Buying a house doesn’t mean walking around the park. In today’s market, it is particularly challenging for first-time buyers.

In the first quarter of 2025, inflation-adjusted list prices fell slightly, but interest rates rose. For the majority of first-time home buyers relying on loans to buy a home, this has eased little by little the affordable way of the first few months of the year.

List prices are slightly lower

Nationwide, inflation-adjusted list prices for the first quarter fell slightly (-2%) compared to the last quarter of 2024. Looking at the adjusted prices, you can see that the buyer’s money can move a little further towards the sticker price at home.

However, data from the National Association of Realtors shows that the number of homes that change hands remains historically low. Some of this may be seasonal – home sales are usually insufficient for the first quarter of the year. However, high prices, high mortgage rates and uncertain economic outlook may also play a role.

Beyond the most populous metro, Detroit (-8%), San Francisco (-5%), Philadelphia (-5%) and Indianapolis (-5%) had the largest quarterly declines.

Homebuyer Tips: Current economic outlook is unknown – consumer sentiment is frequently declining amid changes in economic policy. For example, a recent Nerdwallet survey found that 13% of Americans said they would delay buying a home in the next 12 months due to tariffs. If high prices, high prices, and financial uncertainty are giving you a pause, it may be worth the wait. Use the extra time to save bigger down payments and organize your credit scores. That way, if the time is right, you’ll be ready to go boldly prepare.

Monthly payments that are still out of reach

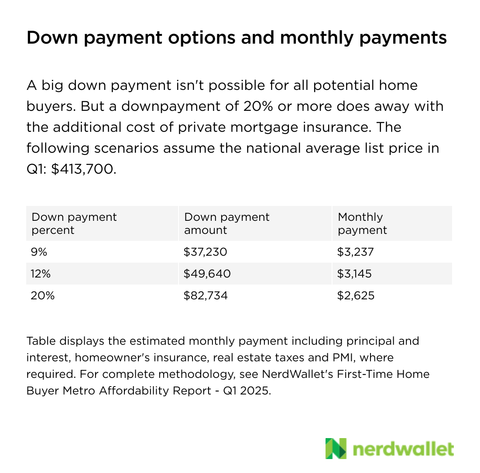

Despite the slight lower prices in many markets, rising mortgage rates offset a large portion of profit. The typical first quarter price was $413,700. With a 9% down payment (average for first-time home buyers last year), buyers will consider paying a $3,240 mortgage each month. This includes homeowner insurance, real estate taxes and private mortgage insurance (required for down payments under 20%).

Your ability to buy a home depends not only on your price, but also on other commitments like your income and unpaid debt.

One rule of thumb suggests that homeowners spend only 28% of their monthly total income on the home. Applying it to the estimated typical home buyer payments for the first quarter, the buyer must make at least $138,700 a year.

Currently, the $3,240 payment is approximately 42% of the current average monthly income for first-time homebuyers-age households.

Home Buyer Tip: When entering the market as a buyer, it’s important to look into all the numbers that enter the monthly home payments, as they can have a big impact on your budget. Max: Your down payment. But shopping for homeowner insurance and the lowest available mortgage rate can also make a difference. Don’t focus solely on home sales prices. These other costs will increase quickly.

List pauses rebound from deep deficits

The number of available homes for sale typically falls slightly in the first quarter of the year, with data retaining trends this year, with the average listing down 7% nationwide compared to the previous quarter. Still, the overall trend is rising. The first quarter listings rose 27% from the same period last year.

Over the country’s most populous metropolitan area, the list fell most dramatically over the quarter in Buffalo, New York, and Grand Rapids, Michigan. However, the biggest improvements over the past year have been seen in Denver (listings rose 62%, up year-on-year), Las Vegas (+59%) and San Diego (+58%).

Home Buyer Tips: In many cases, increasing lists lead to more competition. However, if interest rates are high and the economic outlook is unclear, more homes may not be enough to seduce more buyers. In some markets, this lack of demand could lead to conditions that could benefit home buyers. For example, greater negotiation power. Local real estate agents can help you determine the current market situation you shop for.

Analysis methods and additional graphics available in the original article published on Nerdwallet.

Elizabeth tenant writes for Nald Wallet. Email: elizabeth@nerdwallet.com. Twitter: @elizabethrenter.

Article data: First-time home buyers face bigger headwinds in Q1. It originally appeared in Nerdwallet.

Original issue: June 5th, 2025, 4:37pm EDT