A typical dating profile might showcase photos and interests, but will your debt load swipe someone left? According to a new Nerdwallet survey, 10% of Americans say they never date anyone with credit card debt.

A survey of more than 2,000 US adults commissioned by Nerdwallet and conducted online by Harris Poll asked Americans how much debt breaks contracts in romantic relationships. For most Americans, it depends on the amount and plan to pay it off, or the lack of it.

Credit card debt may be $ 200,000.

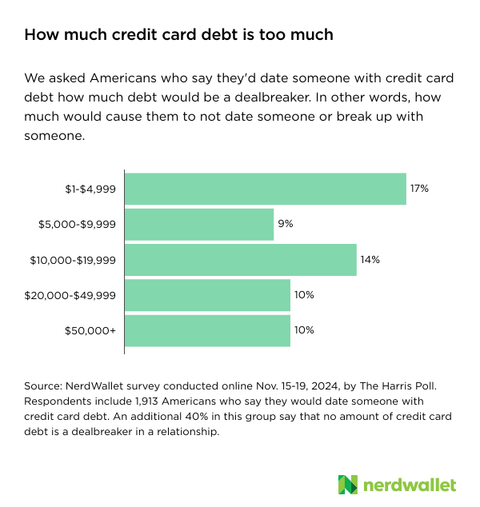

Most Americans (90 %) theoretically date with a credit card debt. In fact, this (40%) says to two in five people (40%) that credit card debt is a break-up in the relationship. However, others say there is a limit to the amount of credit card debt that adheres to romantic partners.

On average, $20,711 is the amount of credit card debt that breaks the relationship contract, but the median is much lower at just $1,000.

The attitude towards debt is different, and many Americans don’t worry about their partner’s balance. Two in five Americans (39%) (39%) say they don’t care how much debt (of any kind) their partner has, and their partner has student loan debt If so, more than three-quarters of Americans (77%) are fine.

What you can: Repay your debt for yourself, not a potential partner

It is best to limit interest costs, pay off debts to give you a breathing room, and you can afford your needs and some desires, and pay for the future. But the truth is that paying off your debt may not result in finding your ideal partner and dating. However, the financial freedom you gain from becoming debt free may open up opportunities to explore different paths of life.

Economic responsibilities are important in life and love

Most Americans (85%) say that financial responsibility is the key quality of a romantic partner. This can mean a lot, but generally, financial responsibility includes living in your means, saving you towards your goals, and investing in the future.

What you can do: get your financial home in order (and help your partner do the same)

Again, financial responsibility is a good goal that you aim to aim to give you peace and options, not because you are potentially able to date more. If your financial house is organized, you are probably less likely to settle for someone who earns more than you, but you may not be an ideal partner.

Practice self -care and spend money to reach a good place. This can help you set goals, track your spending, free up more cash and achieve it. With this know-how, you are better equipped to help your current or future partners do the same.

The payoff plan is a green flag, and the red flag is lying about debt.

If your new partner calls you the wrong name (repeat), it could be the red flag of the relationship. Ibid to lie to you about their debt burden. About two-thirds of Americans (67%) say they don’t continue dating people who lied about how much they have in debt.

Conversely, planning for the future could be a green flag or a positive action. According to the survey, more than three-quarters of Americans (76%) have consumer debt, such as credit card or personal loan obligations, if the person has a plan to pay them back, I learned that they answered that they were not breakers in relationships.

What you can: Honestly about your finances in the relationship

Honesty is the best policy as long as it’s safe to be open with your partner. A person’s value is not determined by the burden of debt, but the amount you owe can affect your relationship. For example, if you are focusing on paying off your debt, you may need to forget to travel together or postpone your wedding. Open up with your partner about your financial situation and become a safe person for them to open up as well.

At the end of the day, many of our harmless relationship “dealbreakers” could go out the window for the right person. Give some bounty as you navigate yourself and your partner, your present or future, financial struggles. Building an economic future together can be more troublesome than you imagined, and it’s fine. As long as you have a compatible financial goal, walking around the turmoil of money may be worth it as you grow and change as a couple.

A complete survey is available in the original article published in Nerdwallet.

Erin El Iissa writes for Nardo Wallet. Email: Erin@nerdwallet.com.

The debt of the article may be a dating transaction that originally appeared in Nerdwallet.

Original issue: February 5th, 2025, 3:01pm EST