Florida’s push to bring sweepstakes casinos under a codified set of rules has taken on a different tone this year. Instead of reacting to a legal battle, the Social Gaming Leadership Alliance is trying to move the conversation forward sooner rather than later. The group represents well-known sweepstakes platforms such as Chumba Casino, McLuck, and Pulsz. These companies have dealt with many disruptions in other states, and that experience appears to have convinced SGLA that Florida needs attention before the situation worsens. With so many residents already playing in these locations, the state became an obvious focus for them.

In 2025, a series of bans at the state level completely changed the atmosphere surrounding sweepstakes casinos across the United States. New Jersey, California, Connecticut, and Montana each tightened their rules through legislation or direct enforcement. Florida is in a strange position by comparison. The platforms still operate openly, and efforts to restrict them have received less attention. Considering Florida is home to approximately 23 million people, the industry can’t afford to ignore it. Efforts to create a long-term regulatory model would be even more meaningful if it were successful in a state of that size.

One of the big stories about SGLA is in the report it commissioned from Eilers & Krejcik. According to the study, Florida accounts for about 8.5% of the national sweepstakes market, which the company values at about $12.5 billion. That’s roughly $1.04 billion for Florida’s players alone. Beyond the report, many residents are already considering a wide range of online gambling options, from Bitcoin casinos to offshore platforms, and often compare different Florida casino options online (https://casinobeats.com/online-casinos/florida-casinos/).

These sites usually emphasize bonuses and stable payouts, giving players a feel for what a regulated digital casino environment is like. SGLA views the actions of this wide range of players as evidence of large-scale participation by Floridians, even in the absence of a formal regulatory structure.

This study goes beyond estimating participation. It outlines what licensing structures could be produced if a state decides to adopt one. Eilers & Krejcik modeled a plan with a license fee of $270,000 per operator and a 6% sales tax on sweepstakes activities. Their calculations suggest potential annual revenue of approximately $62.7 million. This number does not solve the problem of the national budget, but it is not a small change either.

Any discussion of gambling in Florida comes down to the Seminole Tribe, who have long shaped Florida’s gambling landscape. The family operates land-based casinos and operates the state’s online sports betting platform, Hard Rock Bet. The state of Florida does not approve online casino play other than sweepstakes-style sites. Earlier this year, a proposal called SB 1404 attempted to wipe non-tribal online casino-style platforms from the market, but it didn’t go far. These existing dynamics form the backdrop to any strategy pursued by SGLA.

Legal interpretation may be the steepest mountain. Attorney Daniel Wallach has repeatedly stressed that the state constitution gives voters the power to decide whether to allow casino gambling off tribal lands. Any sweeping changes would require a statewide vote. This means that even carefully written regulatory structures can run into difficulties if they avoid a referendum. For the industry, this is a hurdle that money alone cannot assuage.

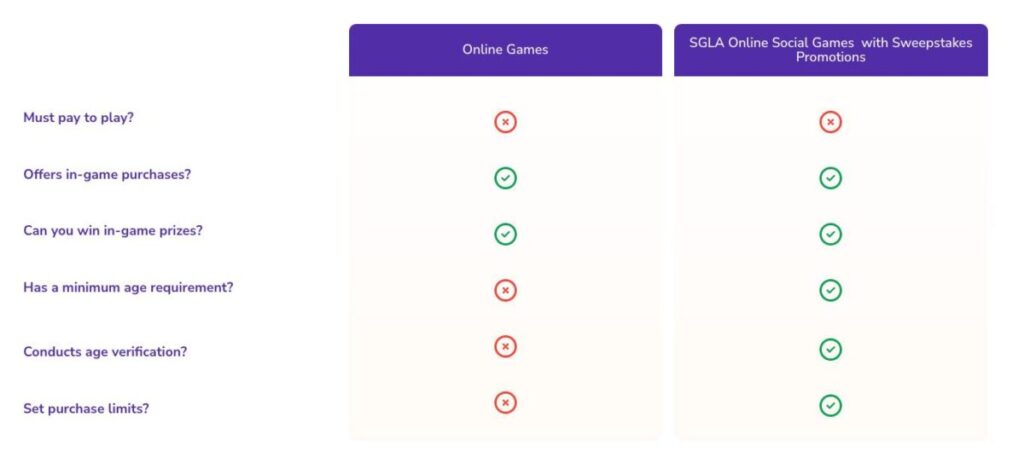

Despite these complexities, SGLA seems committed to speaking out early rather than waiting for regulators to collapse the sector without warning. They have emphasized the work associated with compliance teams, the potential standards a license may enforce, and the financial predictability that comes with formal recognition by a state. This is a different approach from past years, when carriers tended to keep a low profile until a legal battle erupted. SGLA appears to be hoping that with steady engagement, the issue will not escalate into a ban vs. ban debate.

Timing can affect everything. Florida officials have been cautious about reviewing gaming laws, even though the Seminole Compact continues to define much of the state’s gaming policy. Still, pressure from outside is mounting. States that have banned sweepstakes casinos have often done so quickly after brief committee hearings or short public debates. Even if the proposal gains traction, there’s no guarantee that Florida won’t follow the same pattern. SGLA strives to ensure that legislators hear important economic aspects early enough.

Florida’s bill is currently at a stage where several paths remain open. The state could be the first in the country to formally regulate sweepstakes casinos, potentially setting a precedent far beyond its borders. Or they could suddenly move into enforcement and wipe out the industry in a matter of months.