News Analysis

Chinese exporters are rushing to find domestic buyers of consumer goods as orders dried up during a trade war that escalates from the US.

On Chinese social media platforms, exporters took part in the domestic consumer livestream market, initially trying to offload products for foreign customers. Production is slowing or halting in some factories.

Chinese e-commerce giant Raft has launched plans to help exporters pivot towards the domestic market, but some experts say domestic Chinese consumers can’t fill the gap.

If the trade war continues, “damage to China’s economy will be much greater than the impact on the US economy,” Wang, a US-based commentator on China’s issues, told the Epoch Times.

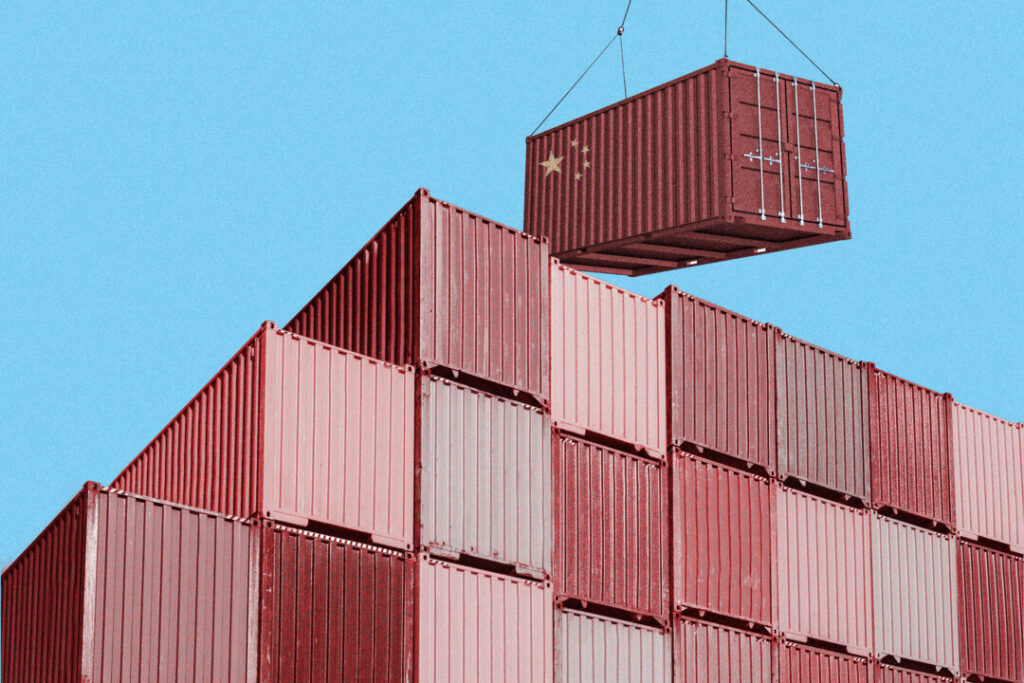

According to the Chinese financial publication Caixin, by April 10, there were few container ships surrounded by the US in Shanghai, and few containers that did not meet that before the deadline was stuck.

Decreased delivery

Mannhei, owner of women’s fashion brand Geling, began live streaming at Shenzhen container yards on April 11th. In a short video until April 22, it was released in a version of Tiktok, Massachusetts, China, where one of his employees said the company had ten containers of clothing laid in container yards and the storage salaries of thousands of Yuans. Ma said he was cleaning up the stock at an 80% discount.

In the app Xiaohongshu, or Renote, dozens of sellers are broadcasting live stream videos showing products produced for customers who are no longer able to sell due to high US tariff rates.

In one livestream, a user with a handle called “Cloud Foreign Trade Warehouse,” which was trying to sell small appliances, including rice farmers, told viewers:

In another video uploaded by user “Muzi has good products”, the seller slammed the appliances while surrounded by boxes marked “trade traffic containers.”

The increase was driven by “particularly high” cancellations of Asia West Coast North America and the Trans-Atlantic route, caused by importers’ hesitation amid tariff uncertainty, the brief said.

On April 12, 2025, a gantry crane and container ship located at Yangtian International Container Terminal in Shenzhen, Guangdong Province, China. Containers that didn’t make China before US tariffs were raised on April 11th were stuck. –AFP via Getty Images

“Cancellations of reservations continue to climb, and some vessels may leave China with considerable free space until May,” the report said. “The continued uncertainty surrounding US and China’s tariffs have caused cargo owners to scramble to offset rising costs, with many cancelling or halting cargo in their hometown.”

On April 20, China’s Huatai Futures said in its weekly shipping report it had tracked eight vessels redirected from the US route to Europe. Investors have proposed to monitor whether more vessels will change routes.

US-based economist Davy Wong told the Epoch Times that a decline in transport is a warning sign for China’s export-driven economy.

“If port throughput drops, it shows that capital and freight flows are broken. It’s not just a logistics adjustment,” he said.

What matters is “unpredictable sinking costs for both cargo owners and buyers,” he said. “Small businesses cannot take orders or ship products. Exports are in a very unstable state.”

Production ceased

Some Chinese workers have even complained about taking them to social media and posting notifications from the company.

Posted on social media in one letter dated March 31, garment factory employees were told to take two weeks off at minimum wage and were told that the reopening of production would depend on whether orders were received or not. Another letter dated February 10 says it will air until May 10th because employees at the electronics manufacturer did not have orders until May 10th.

The Epoch Times could not contact the company for further details.

On April 17, the supervisor of a Chinese textile factory told a Chinese Epoch Times reporter who posed as an interested party that his factory lost about half its order and that the employee’s wages had also been halved as his identity was withheld for his protection.

On April 16, 2025, I will organize my clothing from China’s e-commerce platform at a clothing factory in Guangdong Province, China. Some Chinese workers have posted social media complaints about being abandoned. Jade Gao/AFP via Getty Images

A supervisor who has worked at the factory for over 30 years said that most of the factory’s products have been exported to the US via Vietnam, with daily production recently falling from 80 metric tons to 30-40 metric tons.

“We used to be producing at full capacity. Now we have to take a break every other day,” he said.

The factory also exports to Japan, the European Union and South America, but “everyone has stopped buying because the economic environment isn’t big now,” he said.

“The whole world is worried about a trade war. They’ve all stopped spending,” he said.

“We can keep operations for now, we can see how things evolve. We know that a lot of companies have stopped production and stopped paying their salaries.

Transition to the domestic market

Taiwanese economist Edward Hwang said it is likely that more supply chains will leave China as the trade war continues to escalate.

In that case, China’s economy will “continue bleeding,” unless domestic demand can compensate, he told the Epoch era. “But that seems impossible in the short term.”

Wong noted that as unemployment rates rise, domestic demand will also be affected.

More than a dozen Chinese retail giants have announced measures to ease pressure on exporters.

JD.com has pledged to spend at least 200 billion yuan ($27.4 billion) next year to buy goods from exporters. Freshippo, a subsidiary of Alibaba, has also launched “Green Lane” to simplify the process by which exporters sell to the domestic market on their platform.

Yang Xianghong, CEO of a business consulting firm in Guangzhou, China, said exporters cannot compete as companies are already caught up in a price war in the domestic market.

“High-quality export products are not very compatible with the domestic market. Most domestic consumers are more price-sensitive than anything,” he wrote in a Weibo post on April 14th. He added that the influx of new competitors will exacerbate the race at the bottom.

Luo Ya and Reuters contributed to this report.

Workers sorted the packages for delivery at JD.com warehouse in Beijing on November 11, 2024. More than 12 Chinese retail giants, including JD.com, have announced measures to ease pressure on exporters. Wang Zhao/AFP via Getty Images