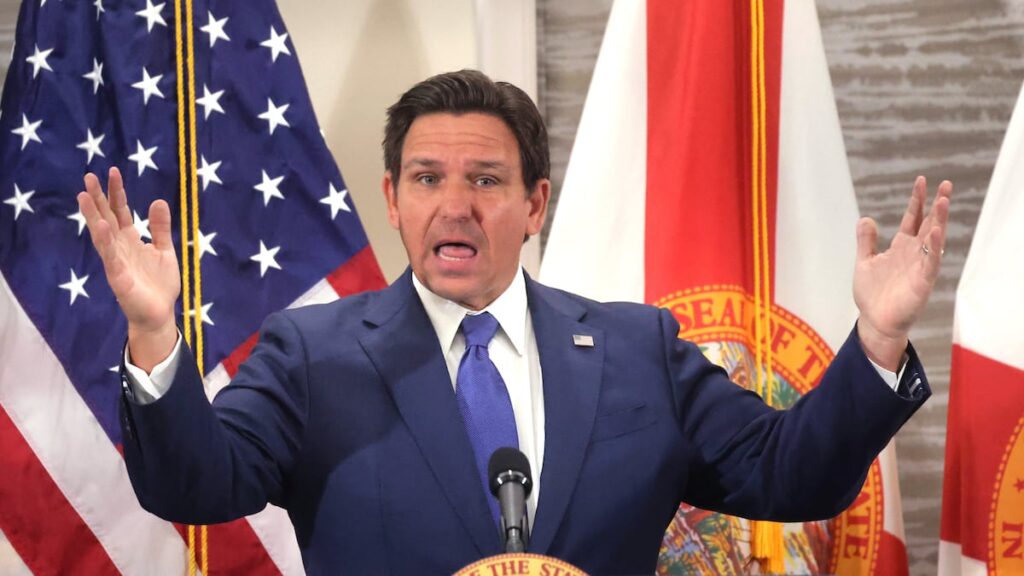

There are good ideas and great ideas. The biggest idea I’ve heard over the years was approved by Gov. Ron DeSantis on February 13th. The abolition of property tax. This will not only make the nation even more attractive to families and job creators, but it will end a very bad tax.

I say this as someone who bought a house in Florida after paying exorbitant property taxes in Illinois for decades. On Lincoln land, this tax is one of the worst ways governments have bound citizens. Sky-High property taxes increase the cost of owning a home, especially for first-time home buyers and fixed income people. Even when property taxes are low, as they are in Florida, they still do the most harm to those who can’t afford it the most. There is something fundamentally unfair about the idea that even if you pay back your home, you have to pay the government for your right to live there.

Property taxes are just as destructive for entrepreneurs. I ran a retail store in Illinois, but within five years my property tax bill went from $22,000 to $100,000. All the pennies in the tax increase made it difficult to pay my team and lower the prices and plan for the future. When I started, I wanted to open an additional store. Property tax made that impossible. Even when property taxes are low, like Florida, they are forcing job creators to spend a lot of money on something that doesn’t help create jobs. They essentially suppress your ability to grow and give back to your community.

Desantis agrees with me by saying, “Taxing land/property is a more oppressive and ineffective form of taxation.” Property taxes are more difficult to understand than most taxes. Because you only encounter it once or twice a year. Compare it to the sales tax listed in all transactions you do. The best taxes are clear, consistent and difficult to procure, as everyone sees them like hawks. Politicians justify the current system by saying, “Don’t worry, it’s for the kids,” but taxpayers should ask if there’s a better way to fund local services like public schools.

If Florida ends its property taxes, effectively everyone in the state will feel instant relief. Homeowners average $2,400 with rising disposable income. Renters will either see rents falling or at least stop the rise. You’ll also find it easier to buy a home, as property taxes are lower or homeownership is easier. And while businesses can grow by giving wage increases, a new generation of entrepreneurs will find it easier to get off the ground. My hometown in Illinois is not to mention the hellish hole of property taxes like in New Jersey.

To be clear, the state was able to find other ways to keep paying for schools, police and other public needs. The state’s sales tax rate probably needs to rise, but not as much as deniers are screaming. That’s because local governments need to ultimately prioritize. Even the wisest city councils are wasting their money. It is the nature of government and is not facing real competition. But eliminating property taxes creates a kind of competition, making politicians realize what’s really important and what’s really not.

Certainly, Florida has come a long way from ending property taxes. As the governor pointed out when he called for change, we need constitutional amendments to make it happen, and we need support from over 60% of voters. State lawmakers have now introduced a bill to study the issue. This is the best next step. Before you can bring this issue to the voters, you need to determine what is feasible.

Spend your days with Hayes

Subscribe to our free Stephenly newsletter

Columnist Stephanie Hayes shares thoughts, feelings and funny business with you every Monday.

You’re all signed up!

Want more free weekly newsletters in your inbox? Let’s get started.

Check out all options

But there’s no mistake. Property taxes need to be eliminated before people in Florida. This is like a positive, thought-provoking, life-changing idea that we should demand for viewing from a political leader. Praise to Desantis because he wants to make America’s biggest nation even bigger.

John Tillman is CEO of the American Culture Project. He lives in Naples.