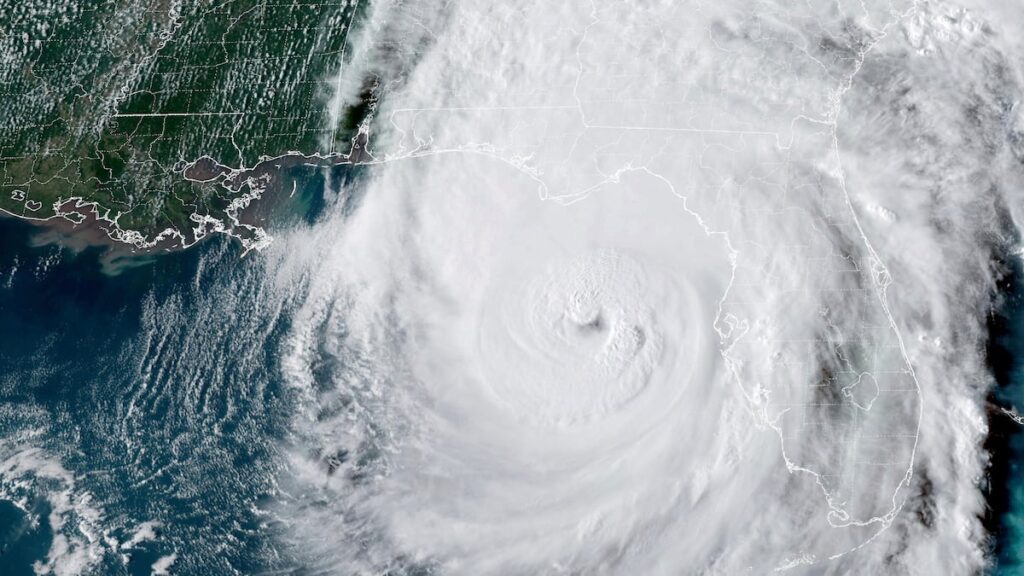

When the next $50 billion hurricane hits Florida, the problem is: Who will pay for it? Many Floridians expect insurance companies to cover the losses, but the reality is a little more complicated.

Insurance companies may run out of premiums and ultimately the financial burden may shift to homeowners and taxpayers. The Florida insurance crisis has put unsustainable hopes of building high-risk areas and being able to pick up tabs for others when disaster strikes.

Florida’s unique climate and growth patterns make it particularly vulnerable to hurricanes, floods and storm surges. This has increased insurance costs, but the high premium simply reflects actual risk. Restricting these premiums with subsidies or caps gives consumers false security and encourages buildings in unsafe zones. This cycle will cover the insurance system, expose more people to economic losses and promote vulnerable markets.

In open markets, price signals are risky. If these signals are distorted, it’s like stealing the warning light. Proper pricing not only prevents risky development, but also promotes safe and sustainable practices by leading homeowners to safe and vulnerable locations.

Government interventions often aim to make insurance more accessible, but in reality they exacerbate the risk. Artificially low premiums invite people to high-risk areas, isolate them from actual costs, creating what is known as moral hazard. If government programs become cheaper to live in flood zones, they unintentionally encourage dangerous buildings and erode incentives for mitigation measures such as fire-resistant construction.

Programs like the National Flood Insurance Program (NFIP) demonstrate this well. Since 1968, NFIP has been offering subsidized flood insurance to make premiums more affordable in high-risk areas. However, at rates that do not reflect actual risk, a small number of assets are repeatedly claiming after the flood, pushing NFIP into billions of dollars in debt. By reducing costs, NFIP promotes a cycle of reconstruction in flood zones, putting taxpayer funds at risk without reducing exposure.

Florida Civic Property Insurance Company offers similar examples. Citizens, established to provide coverage for the last revival, attracted low-price policyholders and encouraged development in hurricane-prone regions. With potential debt currently liable to billions, the state could face a taxpayer crisis if a major hurricane hits.

Although subsidies and price caps only address the surface, resilient communities like Babcock Ranch are excellent case studies showing that strategic planning is possible. Built with advanced stormwater systems, solar power and underground utilities, Babcock Ranch is 25-30 feet above sea level, avoiding flood risk and preserving sustainability even in storms. This approach balances development with long-term risk management, providing a path that does not rely on subsidies, but on smart design and true resilience.

Spend your days with Hayes

Subscribe to our free Stephenly newsletter

Columnist Stephanie Hayes shares thoughts, feelings and interesting business with you every Monday.

You’re all signed up!

Want more free weekly newsletters in your inbox? Let’s get started.

Check out all options

Floridians must recognize that living in paradise has inherent risks. True progress requires shifting focus from short-term premium reductions to address the root causes of rising costs. By allowing insurance prices to reflect actual risks, promote safer building practices, and limit subsidies in cases of true needs, we are able to address future challenges and be realistic. And you can build sustainable markets and states that will better prepare you.

Don Brown is a former state representative and former chairman of the House Insurance Regulation Subcommittee. This opinion article was distributed by the invading sea website (www.theinvadingsea.com). It posts news and commentary on climate change and other environmental issues affecting Florida.