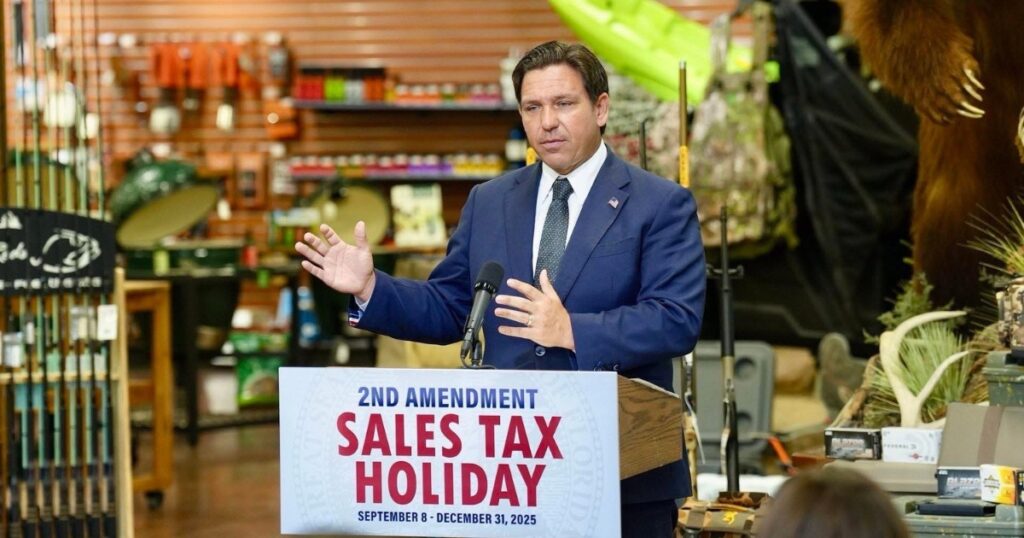

Plant City, FL (September 8, 2025) – Florida suspended the 6% state sales tax on a variety of hunting, fishing, camping and firearms-related items from September 8, 2025 to December 31, 2025, from 2025 to December 31, 2025.

Exemption scope

Sales tax suspension applies to a wide range of products, including:

Firearms and Accessories: Pistols, rifles, shotguns, ammunition, holsters, grips, sights, stocks, cleaning kits.

Bow hunting gear: bows, crossbows and related accessories.

Outdoor equipment:

Camping Lanterns and Flashlights are priced under $30

Camping stoves, hammocks, chairs, sleeping bags for priced under $50

Under $200 tent

Bait/Tackle: Up to $5 individually, $10 if packaged

Tackle Bag/Box: Up to $30

Fishing rods and reels: Up to $75 individually, $150 when sold as a set.

Additional regulations and incentives

As part of the new law, the state will also offer significantly discounted or free services on public shooting ranges for some dates. These include:

The half price range will pass statewide in honor of constitutional freedom and the future 250th anniversary of America.

Veterans’ Free Range Pass on November 9th Veterans Day.

A discounted “5-Year Gold Sportsman License” offered at $250, half the usual $500 cost.

Context and financial background

The tax leave is part of Florida’s broader tax easing strategy encapsulated in the budget from 2025 to 2026, offering approximately $2 billion in statewide tax credits. The budget includes the permanent abolition of business rent taxes and multiple sales tax holidays, combining a $450 million savings for Florida families, and estimates that tax leave could potentially save consumers a significant saving. Florida shoppers predict that they could save $44.8 million through the comparative context of these exemptions.

This level of tax cuts is significantly broader than similar initiatives in other states. Unlike many who limit Second Amendment sales tax holidays to short weekends, Florida’s span is almost four months. State such as Mississippi and South Carolina hold limited-time tax holidays on firearms and related items, but Florida’s expansion approach stands out.