With data breaches and new frauds constantly appearing, you may wonder: how can you keep your financial data safe?

Bad news? That’s not easy, especially considering the increasing sophistication of scammers.

“There’s no silver bullet to protect you from all the threats,” says John Breyault, vice president of public policy, telecommunications and fraud at the National Consumers League, a nonprofit advocacy group.

Good news?

“There are steps you can take to reduce the risk,” he says.

Experts share tips on keeping your financial information safe.

1. Treat all inbound communications with doubts

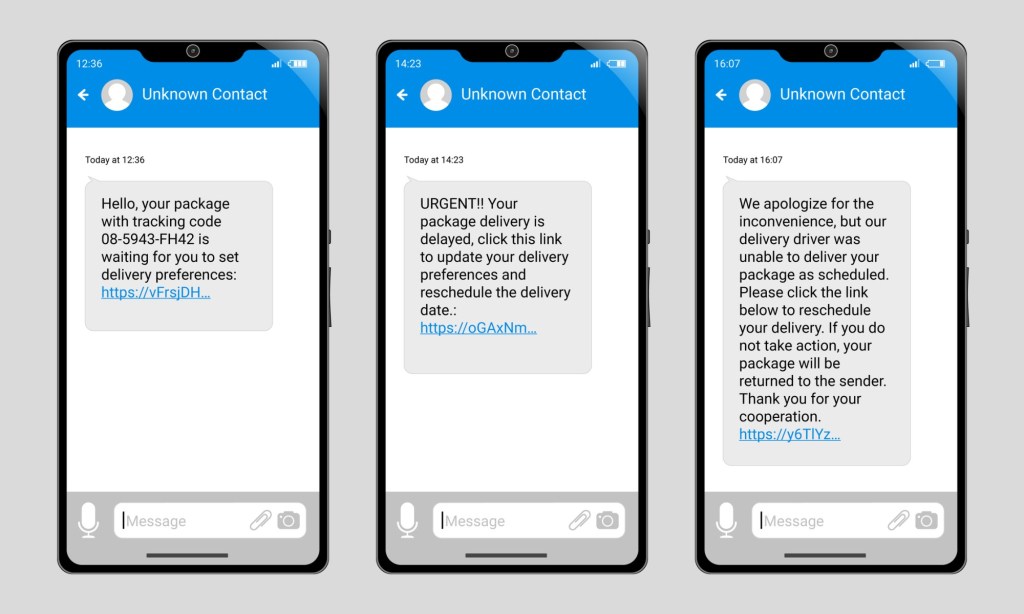

Scams in which fraudsters pretend to be business or financial institutions are one of the most commonly reported frauds to Identity Theft Resource Center, a nonprofit organization that provides personal information crime education and assistance.

“The No. 1 rule is that if someone is offering you a good offer that can’t be too good to you, that’s probably true,” says Clayton Liabraaten, senior executive advisor at TrueCaller, a Caller ID and Spam blocking service.

This includes emails and texts claiming to provide work, money, sweepstakes awards or other prizes.

“The second rule is to be aware of inbound communications that require personal identifiable information,” he adds.

If someone is asking for your address, contact information, Social Security number or bank details, he says he hung up the phone immediately.

Thanks to AI, fraud calls can sound completely legal, making it easier than ever to be fooled into thinking that they are communicating with legitimate callers.

“Everyone can sound like an authority figure,” says Riabraten.

So Yolanda Ayira, which hosts digital literacy classes for seniors at AT&T Connected Learning Centers, encourages participants to immediately close the call if the caller sounds like family but asks for money.

Instead, she suggests hang up the phone and try them out with a known number. Even if your voice sounds like someone you know, it could be AI.

“Telephone and verification,” she says, and don’t worry about being rude when your finances are on the line.

2. Please keep the information private if possible

Whether it’s a Social Security number in a doctor’s office or an app requesting data, it refuses to share sensitive information when possible, suggests Eva Velasquez, president and CEO of Identity Theft Resource Center.

“The more you get out there, the more risks and vulnerabilities it creates for yourself,” she says.

Similarly, consider turning off the “share” or “public” setting for payment apps and other apps using social components. This allows you to make more information private.

“Don’t do it unless you can come up with a specific reason that’s worth sharing that information,” says Velázquez.

3. Monitor (and freeze) credits

We have paid credit monitoring services that can alert you of new credit applications that have been made with your name, large transactions, or other changes to your account.

You can also access free credit monitoring through some banks. The website AnnualCreditreport.com gives you access to our free weekly credit reports.

Velazquez recommends a credit freeze as another safeguard. Freezing your credits will prevent anyone from opening a new account in your name.

“It’s really one of the most robust tools,” she says.

If you wish to apply for a new credit line yourself, you will need to “unfreeze” your credit through each credit office online, by phone or via the mail.

4. Focus on reducing risks you can control

While you may not be able to control a company’s data breach or third party data seller, you can incorporate smart privacy protection into your daily life, says Breyault.

Add two-factor authentication to your financial and email accounts. Do not log in to your financial account on a public Wi-Fi network. Update the operating system software for your device. These are simple but important steps, he says.

Catching fraud early will help minimize damage. You can flag issues early by monitoring your credit card and bank statements for errors.

If you discover a scam, warn your financial institution immediately. You can also report the fraud to your local police, the FBI, the Federal Trade Commission, and your state attorney general’s office.

“Even if you take all these steps, something bad can happen,” Breyo says.

But at least you can minimize the chances of damaging your financial data.

Kimberly Palmer writes for Nald Wallet. Email: kpalmer@nerdwallet.com. Twitter: @kimberlypalmer.

Article 4 four ways to keep your financial data safe originally appeared in Nerdwallet.

Original issue: July 2, 2025, 12:29pm EDT