By Tom Murphy

A small number of employers are becoming less common, leaving health insurance decisions entirely in the hands of workers.

Instead of offering traditional insurance, they are giving workers money to buy their own coverage in what is known as the personal compensation reimbursement arrangement or ICHRA.

Advocates say the approach offers an opportunity to provide something to small businesses that don’t have insurance. It also fits the conservative political goal of reducing the increased costs of employers and giving people more purchasing power to compensate them.

However, Ikras risks finding compensation for employees, and they force them to do a lot of things they don’t like: shop for insurance.

“It may not be perfect, but it solves the problem for a lot of people,” said Cynthia Cox, a nonprofit KFF who studies healthcare issues.

We’ll go into detail how this approach to health insurance is evolving.

What is ICHRA?

U.S. employers who provide health insurance typically have one or two insurance options for their workers through what is called group plans. The employer then acquires most or compensation costs of the premium.

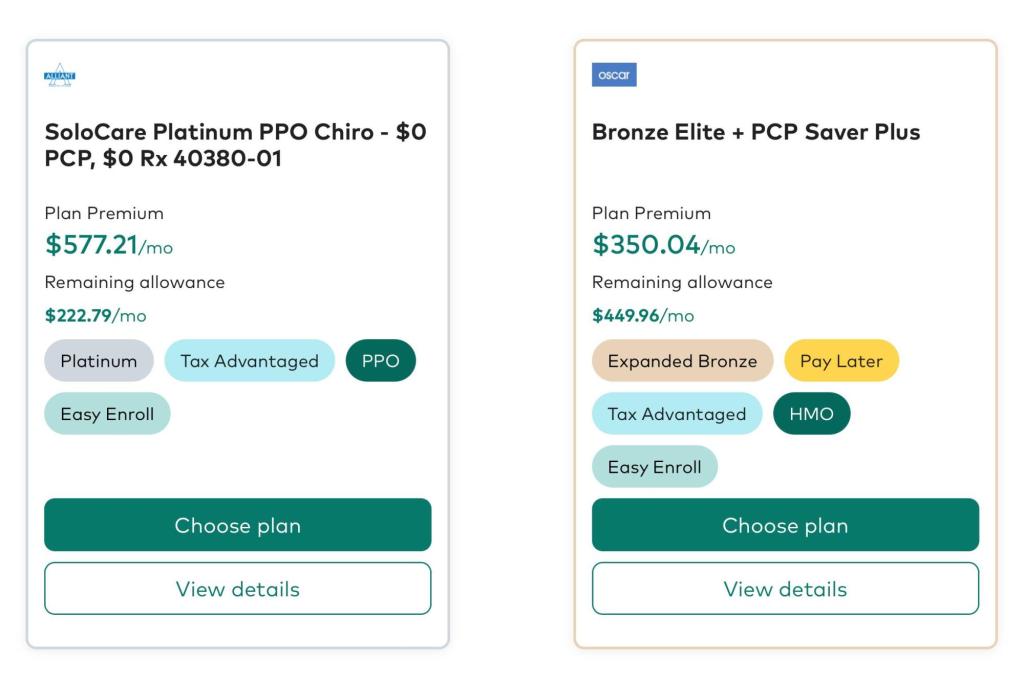

ICHRA is different. Employers contribute to health insurance coverage, while workers choose their own insurance plan. Employers who use Ichras hire outside companies to help people make reporting decisions.

Ikras was created during President Donald Trump’s first administration. Registration began slowly, but has been expanding in recent years.

What’s the big deal about Icras?

They give business owners predictable costs and save the company that doesn’t have to make compensation decisions for its employees.

“We’re looking forward to seeing you in the process of getting started,” said Jeff Yuan, co-founder of New York-based insurance startup Taro Health.

In particular, small businesses can be vulnerable to surges in annual insurance costs, especially if some employees have expensive medical conditions. However, ICHRA’s approach keeps employer costs more predictable.

Yuan’s company is based on how many people are involved in the plan, contributing to the age of employees. This means it could contribute to employee coverage from $400 to more than $2,000 a month.

How is this approach different?

Rather than taking anything the company offers, ICHRAS offers a wide range of options to choose from individual insurance markets.

This may give people the opportunity to find coverage tailored to their needs. For example, some insurance companies offer plans designed for people with diabetes.

Additionally, if workers leave, they can potentially maintain coverage for longer than traditional employer health insurance plans can. They will likely have to pay full premiums, but maintaining coverage means they don’t have to find a new plan to cover their doctors.

Mark Bertolini, CEO of insurance company Oscar Health, noted that most people change jobs multiple times.

“Insurance works best when traveling with consumers,” said an executive who has increased enrollment through ICHRAs in several states.

What are the shortcomings of employees?

Health insurance plans in individual markets tend to have a narrower coverage network than employer-sponsored coverage.

It can be challenging for patients who see several doctors find one plan that covers everything.

Those who shop for their own insurance can find options and conditions for coverage, such as deductions and coinsurance. This makes it important for employers to help them choose their plans.

Brokers or technology platforms that set up corporate ICHRAs generally do this by asking about their medical needs and whether surgery is planned next year.

How many people will be reported using this method?

There is no good national number indicating how many people have coverage through ICHRA or another program for businesses with less than 50 people.

However, the HRA Council, the industry group that promotes arrangements, is seeing great growth. The Council works with businesses that help employers provide ICHRAs. We are studying the growth of those business samples.

Approximately 450,000 people have been compensated this year through these arrangements. This has been an increase of 50% since 2024. Council executive director Robin Paoli said the total market could double.

Still, these arrangements constitute a sliver of employer-sponsored health insurance in the United States. According to KFF, around 154 million people have been registered in the press through their work last year.

Will growth continue?

Some things could offer salmon roe to more employers. As healthcare costs continue to rise, more companies may try to limit their exposure to hits.

Several tax credits and incentives that encourage arrangements in the final version of the Republican tax bill currently under consideration in the Senate.

Also, more people will be eligible for the arrangement if additional government subsidies that will help you purchase compensation in individual markets for Affordable Care Acts expire this year.

If you have already received subsidies from the government, you will not be able to participate in ICHRA, said Brian Blaze, the first Trump administration’s White House health policy advisor.

“Enhanced subsidies, they’re raising private funds,” he said.

The Associated Press School of Health Sciences is supported by the Science and Education Media Group at Howard Hughes Medical Institutions. AP is solely responsible for all content.

Original issue: June 20th, 2025 10:10am EDT