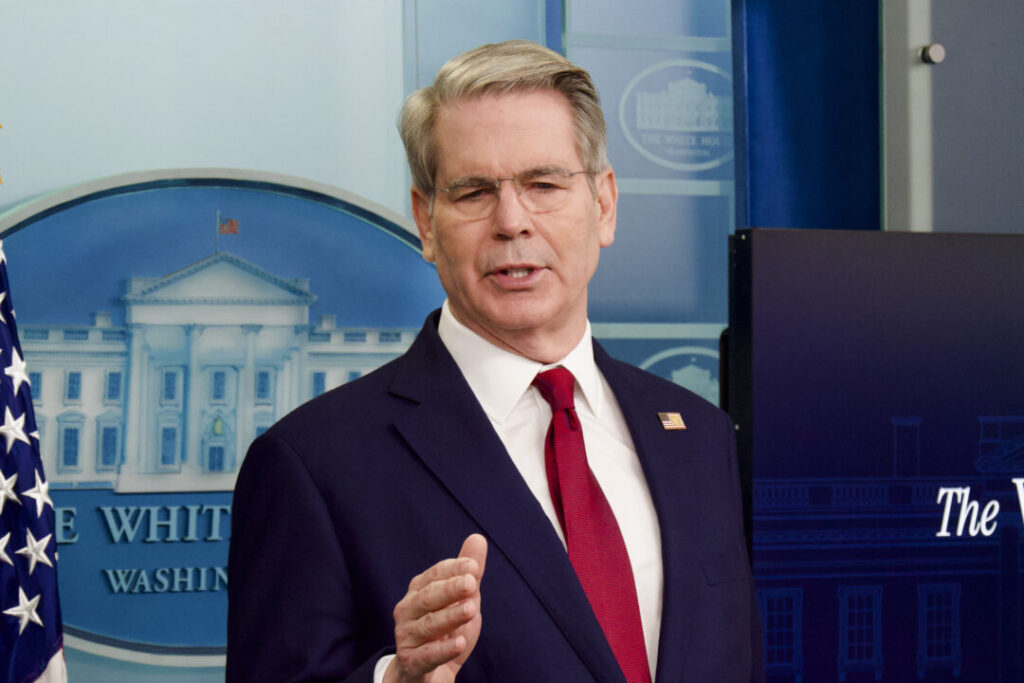

The Treasury Secretary urged the debt restrictions to be raised by mid-July before Congress is closed.

Treasury Secretary Scott Bessent said the federal government is likely to exceed statutory debt restrictions in August, when Congress is scheduled to take a break.

The so-called X-Date timing could put additional pressure on Congress to pass the highly planned sweep policy bill within the coming weeks. This is expected to provide borrowing restrictions and an increase in the prior important parts of President Donald Trump’s agenda, including tax cuts, borders and energy measures.

Bessent informed house speaker Mike Johnson (R-La.) that there was a “rational probability” that the federal government would run out of cash in August.

Johnson hoped to pass the Megaville by May 26th, but the timing appeared to be delayed due to spending cuts, particularly the lack of agreement on Medicaid funding and tax measures.

The immediate aftermath of debt restrictions (the maximum amount the government can borrow to cover its obligations) was revived on January 2nd, with the Ministry of Finance taking extraordinary measures. These efforts included using a general Federal Reserve Treasury account, halting investments in federal retirement funds and redeeming existing investments early.

Bessent has also extended the period of suspension of debt issuance until the end of June.

Over the last few weeks, I have nailed the X date to reach this summer or early fall.

Experts are urging lawmakers to raise their debt cap before the X date to avoid default.

This comes when the Treasury has raised its borrowing forecast for the current quarter.

Updated for 2025

In March, the US government registered a $161 billion budget deficit, down 32% from the previous year, according to a monthly financial statement. In the first half of 2025, the shortfall totaled $1.307 trillion, up 23% from the same period last year.

Compared to 2024, this fiscal year has been slightly higher so far, but it has also been spending more. Expenditures are driven by Social Security ($775 billion), net interest ($48.9 billion), health ($478 billion) and Medicare ($469 billion).

The International Monetary Fund (IMF) said last week that the US federal deficit could fall this year to 6.5% of gross domestic product, down from 7.3% in 2024.

The report took into account President Donald Trump’s April 2nd announcement, but excluded recent trade measures, including a 90-day suspension on mutual tariffs and exemptions on technology imports.

Debt funding is also important to the US government’s finances. As national debt continues to rise, long-term interest rates will rise and debt service payments will be strengthened.

“Specifically, a 10% point increase in GDP in US public debt from 2024 to 2029 could result in a 60 point increase in the 10-year rate five years ago,” the report said.

The benchmark 10-year yield was very volatile in April, trading between 3.99% and 4.5%.

National debt is approximately $36.2 trillion.