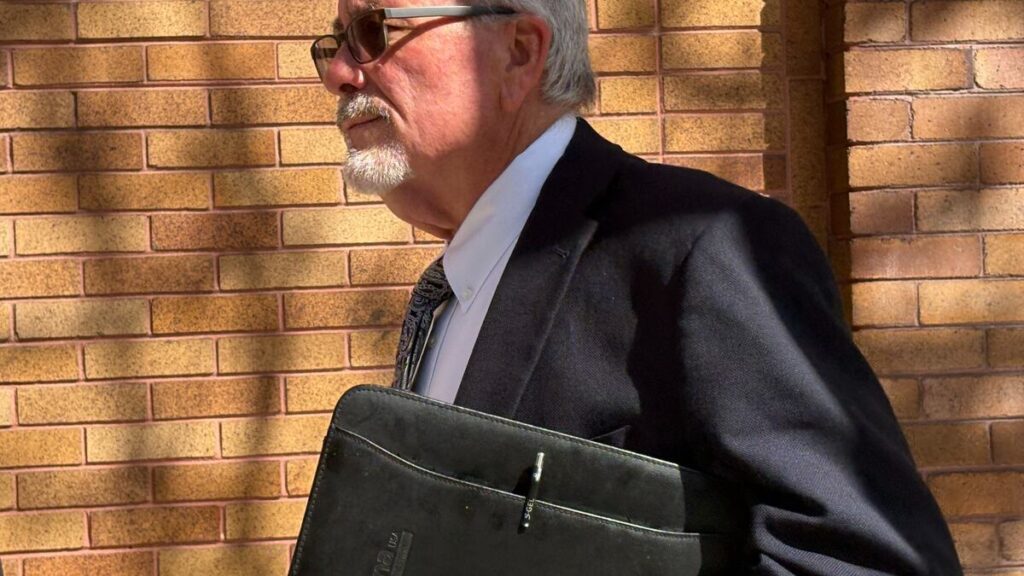

TAMPA – Seven companies are on the block, owned by Leogovoni, a Clearwater businessman who was accused of receiving $100 million from the Medical Trust Fund in court records.

Pinellas County Circuit Court Judge Michael F. Andrews ordered foreclosure sales of businesses identified by bankruptcy trustees appointed by the court to collect money for the more than 1,500 disabled and injured people who were attacked by the Trust Fund.

This list includes BCL Aviation, which once owned Govoni’s private jets, and Seaboard Manufacturing, which manufactures mechanical parts.

The public auction is scheduled for May 20th at Pinellas County Court House. Items must be sold to the highest bidder for cash, the order said.

However, the order also gives the trustee the right to bid on the company as a creditor. Known as a credit bid, it is based on a ruling issued in January by Tampa U.S. Bankruptcy Judge Robert Tacholton, who discovered Govoni and his Boston Finance Group company were liable for a $120 million trust fund and interest.

Michael Goldberg, the court-appointed trustee of Chapter 11, did not return an email or a call seeking comment.

It is unclear how valuable a company is. Govoni, who testified under oath at U.S. Bankruptcy Court in Tampa last week, said some businesses had been abolished.

There are no seven companies own property in the Tampa Bay area on the Hillsboro, Pinellas and Pasco counties real estate appraisal websites.

Other Govoni assets could also be sold or auctioned.

Earlier this month, a federal judge granted the management of bankruptcy officials at several Gobony companies, including Boston Asset Management and Big Storm Brewing, a financial advisory firm that is a craft beer business based on Clearwater’s 49th Avenue. He also owns properties in both Pinellas County and Kentucky.

A warrant for attachments, a legal process aimed at preventing Govoni from selling or dissipating his assets, was also issued last week in the Pinellas County Circuit Court.

Govoni has not been charged with a crime, but is under investigation by the FBI, Securities and Exchange Commission and the Internal Revenue Service.

The Special Neads Trust Administration Center, a St. Petersburg nonprofit founded by Govoni, has moved $100 million to the Boston Finance Company over a decade, according to bankruptcy court records. The transaction was recorded as a loan but was not repaid.

The funds were taken from a trust fund that was established to manage damages caused to victims of road accidents, medical malpractice and other lawsuits, court records say.