Rosie Cima, Nerdwallet

The investment information provided on this page is for educational purposes only. Nerdwallet, Inc. does not provide advisory or intermediary services, nor does it recommend or advise investors to buy or sell certain stocks, securities or other investments.

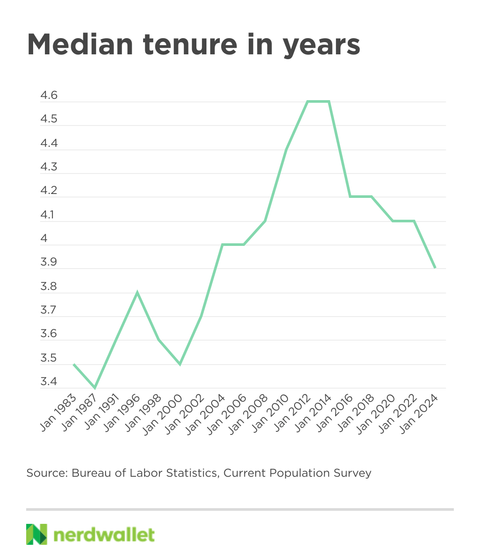

Are you thinking about changing your job? You are a good companion. Data released by the Bureau of Labor Statistics shows that Americans remain in the same job in less time than before.

The hours you worked for your current employer are called your tenure at work. In 2014, the median tenure of duties across all ages, occupations and industries was 4.6 years. In 2024, it fell to 3.9 years. In fact, his tenure is currently the shortest in over 20 years.

Economists are interested in tenure as a measure of employment security and health in the labour market. And individual duties are important to workers. This is because job changes often raise questions about individual finances and future planning.

Tenure Trends

Median duties were generally longer than in the 1980s to 2010. It began to retreat in 2014. Women tend to have shorter tenure than men. This is a gap that began to close in the 2010s but was backed up since. People generally spend more time in the workforce, so tenure increases with age.

Tenure also varies depending on your industry and current occupation.

On average, “managers” people are stuck at the longest five.7 years. This makes sense. The general path to management is when a company promotes long-time employees to the role of supervisory.

If your tenure at work is dramatically above the average for your occupation, it may be a sign that your job is a really good fit. But if you feel that you are unhappy with your job, or that your future at the company is uncertain, you may be considering change.

Consider the benefits of having more tenure

Changing an employer can help you pay for what is worth. Wage growth is generally higher among job seekers, according to data from the Federal Reserve Bank of Kansas City.

However, many workplaces offer incentives to stay. In many cases, senior employees will gain more PTOs, access to development programs, or more employment security. Your time in the company can also be converted to levels of institutional knowledge and respect between colleagues that have not existed for a long time.

Another advantage of seniority is the possibility of progress. If you are not completely satisfied with your current role, your employer may consider what they can do to keep you up. Being ready to leave work is a very strong negotiating position and may help you find a better role in the same company.

It’s unlikely that any of these things will make or break your decision. However, we recommend that you closely examine whether a potentially high salary with a new employer is offset by lower benefits and other trade-offs.

Financial checklist when switching jobs

If you finally decide it’s time to move on, take steps to organize your financial house before submitting your notification.

DO: Make a plan to support yourself financially

You may already have new revenue streams lined up or you may have a job opening for a new position. If not, or if that new job doesn’t pay as much as what you left, you’ll probably want to budget for this transition.

This means looking at your spending, your savings, and how much you expect in the coming months. Even in modest ways, you can buy more time by reducing your spending. When it comes to job hunting, there is a big difference between spending money in six months and running on one.

Don’t: Forget your retirement account

401 (k account, if you have a retirement account sponsored by the most common type of employer, you can leave it on, roll over to another account, or cash it out early.

If your employer is contributing to your retirement account, you need to regain how much of your balance is yours. Your employer’s contribution may only be to bring it with you and with you after a certain number of years with the company.

If you are unsure how much of your retirement account is to the employer portion or your vesting schedule, talk to your HR or finance department.

DO: I have a health insurance plan

Know when your employer’s payment insurance will end and who will guarantee it to you. Temporarily expanding coverage via Cobra is one of several options. Switching to a new insurance company will reset your deduction amount, so if you’ve met or are nearby, it may be a good time to get a postponed healthcare.

do: Cash out the benefits of use-it or-lose-it

Some employers will pay unused PTOs when you leave, but how different it will vary depending on the job. If there are unused days that you don’t pay when you finish, now is the time to use them. If you have a flexible spending account (FSA), you will not follow the following tasks: Find out when it will expire and use it before doing it.

Don’t: Forget your HSA

Unlike FSAs, you can maintain an employer-supplied health savings account (HSA) upon completion. If you have a substantial amount in your account – don’t track that money, especially if you choose to invest. You can choose to leave your HSA as is, or you can transfer your funds to a new HSA and consolidate them.

DO: Get a good reference

When providing notifications, please communicate clearly, sincerely and professionally. Do your best to say goodbye to a positive note. Your final weeks at work are a good time to thank your colleagues and bosses for working with you and ask if you are willing to provide future references.

Rosie Cima writes for Nerdwallet. Email: article@nerdwallet.com.

Article job tenure is declining: What to do before you quit originally appeared in nerdwallet.

Original issue: March 19, 2025, 3:10pm EDT